HSV - 1 Virus New Scientific Paradigm Exploring HSV - 1 Virus Activation as Potential Underlying Cause of Fibromyalgia and Other Chronic Conditions Investor Presentation Initial Public Offering Filed Pursuant to Rule 433 Issuer Free Writing Prospectus dated October 15, 2020 File No. 333 - 248447

Statements in this presentation contain “forward - looking statements” that are subject to substantial risks and uncertainties. Forward - looking statements contained in this presentation may be identified by the use of words such as “anticipate,” “expect,” “believe,” “will,” “may,” “should,” “estimate,” “project,” “outlook,” “forecast” or other similar words, and includ e, without limitation, statements regarding Virios Therapeutics Inc.’s expectations regarding the trading of its shares on the NASDAQ Capital Market and the timing and likelihood of success of future clinical trials. Forward - looking statements are based on our current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward - looking statements are based on assumptions as to future events that may not prove to be accurate. These and other risks and uncertainties are described more fully in the section titled “Risk Factors” in the final prospectus related to our initial public offering filed with the Securities and Exchange Commission ("SEC"). Forward - looking statements contained in this presentation are made as of this date, and we undertake no duty to update such information except as required under applicable law. We have filed a registration statement (including a preliminary prospectus) with the SEC for the offering to which this communication relates. The registration statement has not yet become effective. Before you invest, you should read the preliminary prospectus in that registration statement (including the risk factors described therein) and other documents that we have filed with the SEC for more complete information about us and this offering. We encourage you to read the registration statement and the prospectus in full for more detailed information on the statistics, reports and clinical trials referenced in this presentation. You may access these documents for free by visiting EDGAR on the SEC Web site at http://www.sec.gov. Alternatively, we or any underwriter participating in the offering will arrange to send you the prospectus if you contact ThinkEquity , a division of Fordham Financial Management, Inc., Prospectus Department, 17 State Street, 22 nd Floor, New York, New York 10004, telephone: (877) 436 - 3673 or e - mail: prospectus@think - equity.com. Forward Looking Statements Disclaimer Free Writing Prospectus Disclaimer 2

Offering Summary 3 Issuer Virios Therapeutics, Inc. Expected Offering Size $30,000,000 Expected Price Range $9.00 - $11.00 Shares Offered 3,000,000 (450,000 over - allotment option) Listing / Symbol Nasdaq / VIRI Use of Proceeds • Execute IMC - 1 fibromyalgia Phase 2b clinical trial • IMC - 1 chronic toxicology studies • Manufacture investigational drug for the Phase 2b study & chronic tox study • Scale clinical manufacturing process for Phase 3 • Design irritable bowel syndrome proof of concept trial Sole Book - Runner ThinkEquity, a division of Fordham Financial Management, Inc.

Virios Therapeutics Overview 4 The Fibromyalgia (FM) Market is Large but Dissatisfied Lead Candidate, Oral IMC - 1, Demonstrated Significant Pain Reduction and Tolerability Benefits in P2a FM Clinical Trial Market Analysis Shows Significant Commercial Potential for a New, Differentiated FM Product Virios Team Has Extensive Experience in Developing and Commercializing both FM and Antiviral Therapies Differentiated Antiviral Approach, Combining famciclovir and celecoxib, Garnered IMC - 1 First Ever FDA Fast Track Review Designation for Treatment of FM

Proven Executive Team with Experience in Fibromyalgia (FM) Development and Commercialization 5 Management Directly Involved In Launch of Lyrica® and Savella ® for FM Greg Duncan Chairman & CEO Rick Burch President* R. Michael Gendreau MD, PhD CMO Ralph Grosswald VP of Operations Angela Walsh VP of Finance Pharma Experience includes Notable Medicines *Mr. Burch will resign as President and will be appointed as a Director upon the completion of our corporate conversion.

Experienced Board of Directors, Including Expertise Developing & Commercializing Leading Antiviral Therapies 6 Rich Whitely, MD Abel De La Rosa, PhD John Thomas, CPA Rick Keefer Skip Pridgen, MD Founder • Distinguished Professor Loeb Scholar Chair in Pediatrics, and Professor of Microbiology, Medicine and Neurosurgery, UAB • Gilead's Board of Director • Co - Founder & Co - Director, Alabama Drug Discovery Alliance • 380 Publications • Obama H1N1 Task Force • Remdesivir was Originally Developed by Dr Whitley’s team at UAB • CEO, Director, co - founder of Antios Therapeutics • Chief Scientific Officer of Drug Innovation Ventures at Emory • Led Bus Dev for Pharmasset through acquisition by Gilead Sciences (NASDAQ: GILD) for $11.5 billion in 2012 • Provided Business and Scientific Leadership for Development Programs for the Treatment of HIV, Hepatitis B and C, including Sofosbuvir • CorMatrix Cardiovascular DemeRx , Inc. • MiMedx Group, Inc. • DARA BioSciences • GMP Companies • MRI Interventions • EnterMed, Inc. • Medicis Pharm Corp. • CytRx Corp • 30 - year Pharma industry veteran with broad - based experience in leading commercial operations. • Seven - time winner of Pharma Voice’s top 100 leaders in healthcare • Executive roles at Pharmacia, Pfizer, Wyeth, Biovail and Publicis Health • Company Founder • Board - certified surgeon practicing with Tuscaloosa Surgical Associates, P.C. • Spent nearly 20 years searching for effective treatments in IBS, FM, and CFS/ME • Served as a physician and surgeon in the United States Navy The board also includes current executives, Greg Duncan and Rick Burch

Scientific Advisory Board Includes Top Global FM Thought Leaders 7 Daniel J. Clauw, MD Chair: Professor of Anesthesiology, Medicine (Rheumatology) and Psychiatry at the University of Michigan Director of the Chronic Pain and Fatigue Research Center Lesley M. Arnold, MD Professor of Psychiatry and Behavioral Neuroscience at the University of Cincinnati College of Medicine Dedra S. Buchwald, MD Professor in the Department of Epidemiology at the University of Washington School of Medicine Joel D. Baines, VMD, PhD Joel Baines is dean of the Louisiana State University, School of Veterinary Medicine Michael Camilleri, MD Professor of Medicine (Gastroenterology), Pharmacology and Physiology at Mayo Clinic

Fibromyalgia Disease Overview 8 • FM is a Chronic Disease that Affects up to 8% of the US Population • Hallmark Characteristics are Widespread Chronic Pain and Severe Fatigue – Symptoms Present for ≥ 3 Months • Other Symptoms May Include GI, Sleep, Mood Disorder and Headache Devastating Impact • Patients with FM > 3x Risk of Committing Suicide v. General Population • High Healthcare Utilization and Significant Disability • An Estimated 40% of FM Patients are Treated with Opioids - Opioid - treated FM Patients have Worse Outcomes than Those Not on Opioids Disease Characteristics

0 50 100 150 200 250 300 Asia Africa Europe Latin America 3% Prevalence 6% Prevalence 10.0 M 3.6 M 2.0 M Total FM Patients Diagnosed Patients Treated Patients The Fibromyalgia Market is Large and Poised for Growth if Better Therapeutic Options Emerge 9 Worldwide FM Prevalence Ranges From 3% - 6% of the Population Significant US FM Market Growth Potential Still Exists 36% Diagnostic Rate 20% Treatment Rate 139M 279M 40M 80M 22M 44M 20M 39M Est. 221M - 447M FM Patients Across the Globe

Polypharmacy and Utilization of Unapproved Therapies Demonstrates Significant Unmet Need 10 Approved FM Medications Not Approved for FM 75% 25% 26.8% 24.5% 8.9% 0% 10% 20% 30% 40% Cymbalta (duloxetine) Lyrica (pregablin) Savella Approved Medicines 39.5% Opioid Therapy • 2.0M Rx Treated FM Patients • Avg 2.6 Rx per Patient Share of US Treated FM Patients by Therapy

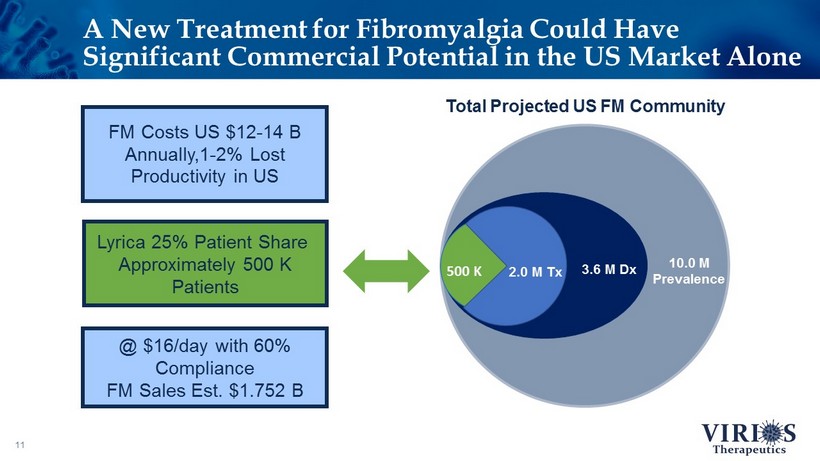

A New Treatment for Fibromyalgia Could Have Significant Commercial Potential in the US Market Alone 11 3.6 M Dx 10.0 M Prevalence Total Projected US FM Community 500 K Lyrica 25% Patient Share Approximately 500 K Patients 2.0 M Tx @ $16/day with 60% Compliance FM Sales Est. $1.752 B FM Costs US $12 - 14 B Annually,1 - 2% Lost Productivity in US

HSV - 1 virus Virios Discovery – Reactivation of Latent HSV - 1 Virus Triggers Overactive Immune Response, and Manifestation of FM

Discovery Implicates Dormant HSV - 1 Reactivation Triggers Immune Response and Manifestation of Fibromyalgia 13 More Than 3.7 Billion People Under the Age of 50 – or 67% of the Population are infected with Herpes Simplex Virus Type 1 (HSV - 1), According to WHO

IMC - 1’s Synergistic Antiviral Mechanism Serves as Basis for Proposed Fibromyalgia Treatment Effect 14 IMC - 1 is a Proprietary Fixed Dose Combination of Famciclovir and Celecoxib that Cannot be Replicated Using Available Generics IMC - 1 Inhibits HSV - 1 Virus, FM Pain Reduced

15 Viral GI Tissue Study: Patient population: • 30 Patients who Presented with Both FM and a Chronic GI Disorder • 15 Control Patients, No FM or GI Disorder GI Biopsies were Evaluated for Herpesvirus Infection: • Analysis for ICP8 Viral Protein • ICP8 Only Present During Active HSV - 1 Infection • PCR was Used to Detect Herpesvirus DNA IMC - 1 Target Antiviral Mechanism Corroborated by GI Biopsy Research Executed with the University of Alabama 0 5 10 15 20 25 30 FM+GI Control Number of Patients HSV-1 No HSV-1 Active HSV - 1 Infection (ICP8) (Fisher’s Exact Test) P =<0.0001

HSV - 1 virus IMC - 1’s Potential Identified in Statistically Significant Phase 2a Trial Results

Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 IMC - 1 N = 69 Placebo N = 74 17 Design Summary: • Randomized, Double - blind, Multi - center, Placebo - controlled • IMC - 1 (famciclovir + celecoxib) vs Placebo, Dosed BID • Famciclovir Dose Not Optimized • Diagnosis of Fibromyalgia Using 2010 ACR, Assessments at Weeks 6, 12 and 16 • Stop Taking NSAIDs at Randomization • 7 - day Washout of FM Drugs and Opioids IMC - 1: Phase 2a Clinical Proof of Concept Trial Primary Endpoints Reduction in Pain Key Secondary Endpoints PGIC, FIQ - R Domains, 30% & 50% pain responder analyses Week 6 Week 12 Week 16 Received study drug treatment for a total of 16 weeks Baseline Patients 18 – 70 Years Old Randomized 1:1 (N = 143)

IMC - 1 Demonstrated Statistically Significant Reduction in Pain in Phase 2a Clinical Trial 18 - 1.9 - 2.2 - 1.1 - 0.92 -2.5 -2 -1.5 -1 -0.5 0 NRS 24-hour Recall FIQ-R 7-day Recall IMC - 1 Placebo p = 0.031 p = 0.001 Decrease in Pain Analysis at 16 Week Endpoint

IMC - 1 Treatment Resulted in Consistent Treatment Effects at 16 Weeks Across Spectrum of Fibromyalgia Endpoints 19 Secondary Endpoints P Value PROMIS (NIH) Fatigue Assessment p=0.001 PGIC - Patient’s Global Impression of Change P=0.040 FIQ - R - Revised Fibromyalgia Impact Questionnaire Total Score p=0.002 FIQ - R – Functional Domain p=0.004 FIQ - R – Overall Impact Domain p=0.003 FIQ - R – Symptoms Domain p=0.004 Pain Responder Analysis – 50% Pain Reduction • 24 Hour Recall NRS • 7 Day Recall NRS p=0.009 p=0.001 Pain Responder Analysis – 30% Pain Reduction 24 Hour Recall NRS @ week 16 7 Day Recall NRS @ week 16 p=0.052 p=0.012 Use of Rescue Medication p=0.037

IMC - 1 Had a Lower Discontinuation Rate Versus Placebo in Fibromyalgia Phase 2a Study 20 Category Placebo IMC - 1 IMC - 1 Difference Randomized 74 69 Completed 16 weeks on study drug 45 (60.8%) 57 (82.6%) 22% Discontinuation reasons: Adverse event 12 (16.2%) 4 (5.8%) 2.8X reduction Therapeutic failure 12 (16.2%) 5 (7.2%) 2.3X reduction Other 5 (6.8%) 3 (4.4%) 1.5X reduction (p=0.012)

IMC - 1 Phase 2b Design Using Optimized IMC - 1 Dosage 21 Secondary Endpoints: Change in fatigue, sleep disturbance, global health status, and patient functionality FM Patients 2016 ACR criteria Age 18 - 70 Sample Size 460 (~230/arm) Treatments IMC - 1 vs Placebo Daily Assessments 16 Weeks Design: Randomized, double - blind, multi - center, placebo - controlled trial Primary Endpoint: Reduction in pain 2020 2021 2022 Q4 Q1 Q2 Q3 Q4 Q1 Manufacture Clin Supply Study Start - up Enrollment Study Duration P2b Topline Results Chronic Toxicology Study Will Run in Parallel with the P2b Clinical Trial

IMC - 1 Pipeline Potential Extends to Other Functional Somatic Syndromes 22 HSV - 1 Infects 67% of People < Age 50 • IMC - 1 Statistically Significant P2a FM data • FDA Fast Track Review Designation FIBROMYALGIA • Univ. of AL GI Biopsy Data Confirm Active HSV - 1 in IBS • ROME IV Criteria Places Increasing Focus on Pain IRRITABLE BOWEL SYNDROME • Viral infections possible triggers of CFS/ME • IMC - 1 Statistically Significant Reduction in Fatigue CHRONIC FATIGUE SYNDROME / MYALGIC ENCEPHALITIS

23 Issued Patents (Expire 6 Feb 2033): Virios Has 20 Existing Patents that All Provide Protection to 2033 Issued US IMC - 1 Patents • U.S. “Composition of Matter” Patents (US 8,809,351 & US 10,034,846) Drug - combination of famciclovir + celecoxib • U.S. “Method - of - Use” Patent (US 9,040,546) Famciclovir + celecoxib for the treatment of FM, CFS or IBS • U.S. “Method - of - Use” Patent (US 9,173,863) Method of dispensing famciclovir + celecoxib in a regimen to treat Functional Somatic Syndrome conditions • U.S. “Composition of Matter” Synergistic Patent (US 10,251,853) Synergistic combination for total daily dose of famciclovir + celecoxib Issued Foreign IMC - 1 Patents • European Patent (EP 2 811 833 & 2 965 759) • Japan (JP 5855770 & 6422848) • China (CN 104144606) • Australia (AU 2013217110) • Korea (KR 10 - 1485748) • Canada (2,863,812) Patents Covering Other Anti - Viral Combinations • US 9,682,051 (acyclovir/meloxicam) • US 8,623,882 (acyclovir/diclofenac) • US 9,259,405 (famciclovir/diclofenac) • US 9,642,824 (valacyclovir/diclofenac) • US 9,980,932 (valacyclovir/meloxicam) • US 10,543,184 (acyclovir/celecoxib) • US 10,632,087 (famciclovir/meloxicam) • EP 2 965 759 (all combinations)

Capitalization Table - Pro Forma Pre - Offering 24 Common Shares 1 5,125,000 Warrants 2 134,663 Options 3 528,125 1 Includes underlying shares for conversion of convertible notes and 292 , 500 of vested non - qualified options assuming a $ 10 . 00 offering price, the mid - point of the expected price range . 2 Warrants are exercisable in cash within 30 days of pricing at an exercise price of $ 7 . 80 assuming a $ 10 . 00 offering price . 3 Includes options issued in connection with this offering equal to 6 . 5 % of outstanding shares assuming a $ 10 . 00 offering price, the mid - point of the expected price range .

HSV - 1 virus Q&A