| HSV-1 virus Virios Therapeutics, Inc. (Nasdaq: “VIRI”) New Scientific Paradigm Exploring Herpes Simplex 1 (HSV-1) Virus Activation as Potential Underlying Cause of Fibromyalgia (FM) and Other Chronic Conditions Investor Update Q1 2021 1 |

| Forward Looking Statements 2 Statements in this presentation contain “forward-looking statements” that are subject to substantial risks and uncertainties. Forward-looking statements contained in this presentation may be identified by the use of words such as “anticipate,” “expect,” “believe,” “will,” “may,” “should,” “estimate,” “project,” “outlook,” “forecast” or other similar words, and include, without limitation, all statements other than those regarding historical facts, statements regarding Virios Therapeutics, Inc.’s expectations regarding our future financial or business performance, plans, prospects, trends or strategies, objectives of management, competition and other financial and business matters; the potential, safety, efficacy, and regulatory and clinical progress of our current and prospective product candidates, planned clinical trials and preclinical activities, and projected research and development costs; the estimated size of the market for our product candidates; and the timing and success of our development and commercialization of our anticipated product candidates and the market acceptance thereof. Forward-looking statements are based on our current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: the outbreak of the novel coronavirus disease, COVID-19, has adversely impacted and may continue to adversely impact our business, including our preclinical studies and clinical trials; our limited operating history, which may make it difficult to evaluate our current business and predict our future success and viability; we have and expect to continue to incur significant losses; our need for additional funding, which may not be available; our substantial dependence on the success of our lead product candidate; failure to identify additional product candidates and develop or commercialize marketable products; the early stage of our development efforts; potential unforeseen events during clinical trials could cause delays or other adverse consequences; risks relating to the regulatory approval process or ongoing regulatory obligations; our product candidates may cause serious adverse side effects; our reliance on third parties; effects of significant competition; the possibility of system failures or security breaches; risks relating to intellectual property; our ability to attract, retain and motivate qualified personnel; and significant costs as a result of operating as a public company. These and other risks and uncertainties are described more fully in the section titled “Risk Factors” in tin the Annual Report on Form 10-K for the year ended December 31, 2020 filed with the Securities and Exchange Commission (“SEC”) and elsewhere in our filings and reports with the SEC. While we may elect to update these forward-looking statements at some point in the future, we assume no obligation to update or revise any forward-looking statements except to the extent required by applicable law. Although we believe the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Accordingly, readers are cautioned not to place undue reliance on these forward-looking statements. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such data and estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. Neither we nor our affiliates, advisors or representatives makes any representation as to the accuracy or completeness of that data or undertake to update such data after the date of this presentation. You should read the documents that we have filed with the SEC for more complete information about us. We encourage you to read such documents in full for more detailed information on statistics, reports and clinical trials referenced in this presentation. You may access these documents for free by visiting EDGAR on the SEC website at http://www.sec.gov. |

| Virios Therapeutics Summary 3 Virios Team and Board of Directors Have Deep Experience in Developing and Commercializing FM and Antiviral Medicines The FM Market is Large, but Dissatisfied – Significant Commercial Potential for Differentiated New FM Treatment Unique IMC-1 Antiviral Combination (famciclovir & celecoxib) Garnered FDA Fastrack Review Designation, Patent Coverage Until 2033 Positive IMC-1 P2b Results in Q2 ‘22 Could Transform FM Patient Care Our Lead Asset, Oral IMC-1, Demonstrated Significant FM Pain Reduction and Tolerability Benefits in Phase 2a Clinical Trial |

| Proven Leadership Team with Experience in Fibromyalgia (FM) Development and Commercialization 4 Pharma Brand Development & Commercialization Experience Includes Management of: Greg Duncan Chairman & CEO R. Michael Gendreau MD, PhD CMO Ralph Grosswald VP of Operations Angela Walsh SVP of Finance E X E C U T I V E T E A M |

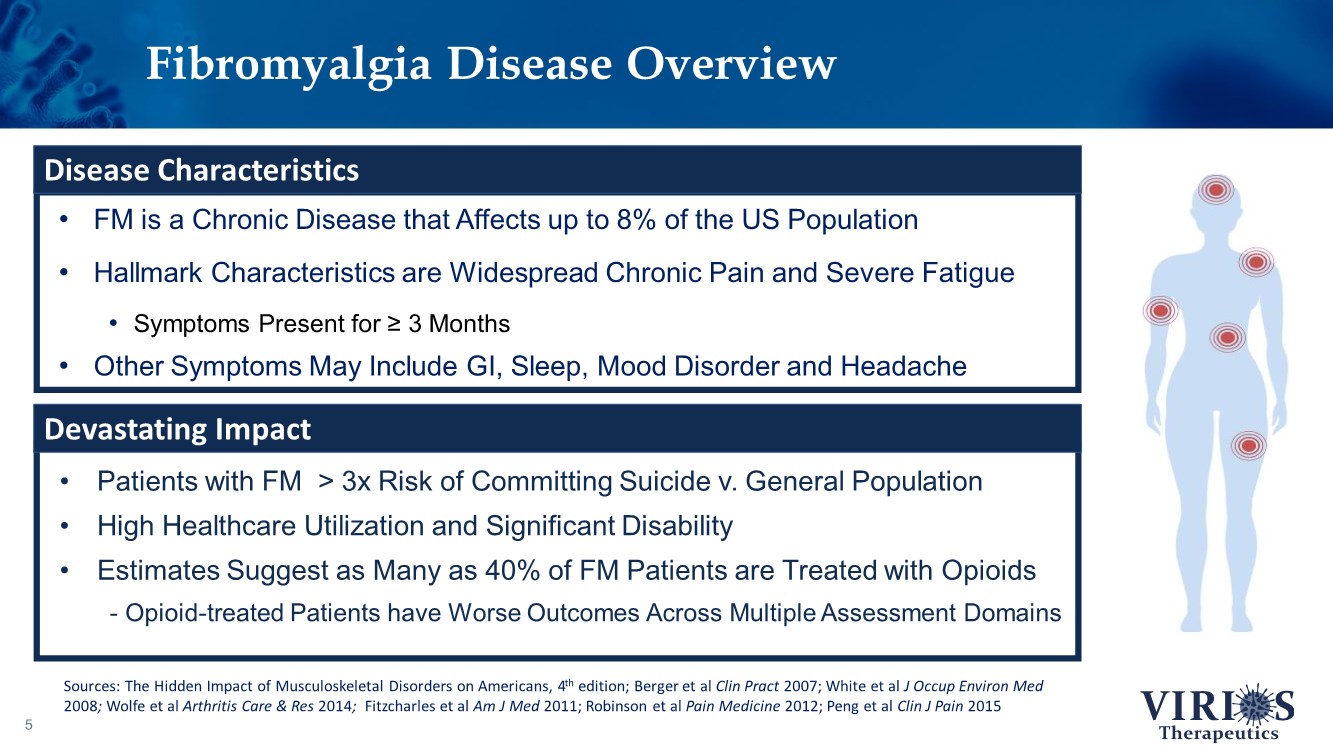

| Fibromyalgia Disease Overview 5 • FM is a Chronic Disease that Affects up to 8% of the US Population • Hallmark Characteristics are Widespread Chronic Pain and Severe Fatigue • Symptoms Present for ≥ 3 Months • Other Symptoms May Include GI, Sleep, Mood Disorder and Headache Devastating Impact • Patients with FM > 3x Risk of Committing Suicide v. General Population • High Healthcare Utilization and Significant Disability • Estimates Suggest as Many as 40% of FM Patients are Treated with Opioids - Opioid-treated Patients have Worse Outcomes Across Multiple Assessment Domains Disease Characteristics Sources: The Hidden Impact of Musculoskeletal Disorders on Americans, 4th edition; Berger et al Clin Pract 2007; White et al J Occup Environ Med 2008; Wolfe et al Arthritis Care & Res 2014; Fitzcharles et al Am J Med 2011; Robinson et al Pain Medicine 2012; Peng et al Clin J Pain 2015 |

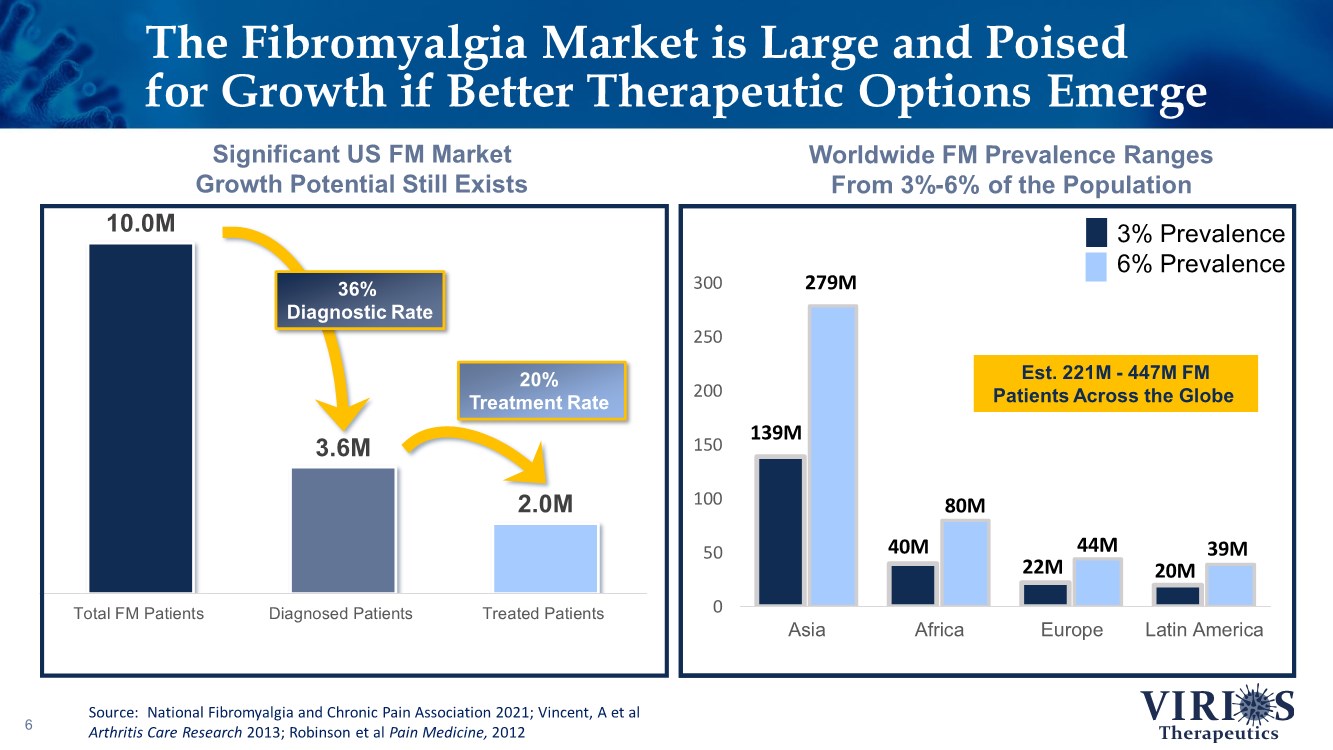

| 0 50 100 150 200 250 300 Asia Africa Europe Latin America 3% Prevalence 6% Prevalence 10.0M 3.6M 2.0M Total FM Patients Diagnosed Patients Treated Patients The Fibromyalgia Market is Large and Poised for Growth if Better Therapeutic Options Emerge 6 Worldwide FM Prevalence Ranges From 3%-6% of the Population Significant US FM Market Growth Potential Still Exists 36% Diagnostic Rate 20% Treatment Rate 139M 279M 40M 80M 22M 44M 20M 39M Est. 221M - 447M FM Patients Across the Globe Source: National Fibromyalgia and Chronic Pain Association 2021; Vincent, A et al Arthritis Care Research 2013; Robinson et al Pain Medicine, 2012 |

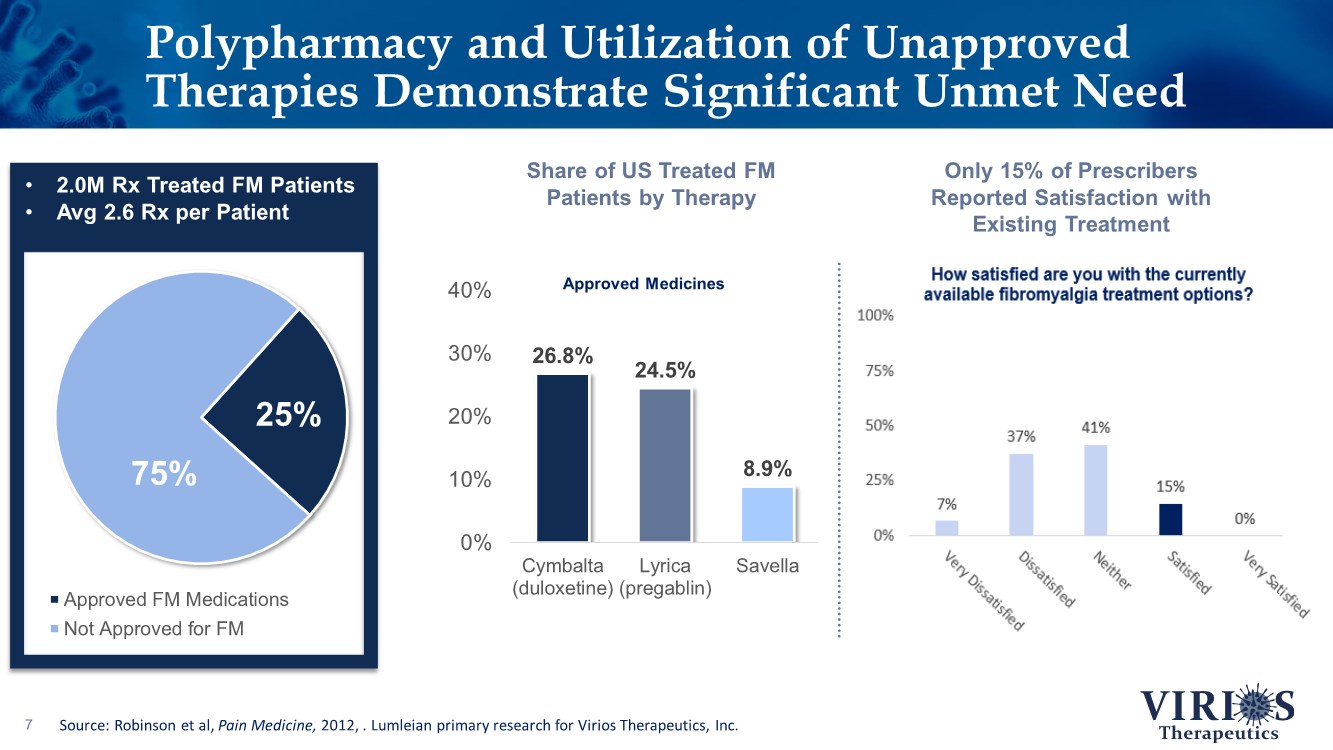

| Polypharmacy and Utilization of Unapproved Therapies Demonstrate Significant Unmet Need 7 Approved FM Medications Not Approved for FM 75% 25% 26.8% 24.5% 8.9% 0% 10% 20% 30% 40% Cymbalta (duloxetine) Lyrica (pregablin) Savella Approved Medicines • 2.0M Rx Treated FM Patients • Avg 2.6 Rx per Patient Share of US Treated FM Patients by Therapy Source: Robinson et al, Pain Medicine, 2012, . Lumleian primary research for Virios Therapeutics, Inc. Only 15% of Prescribers Reported Satisfaction with Existing Treatment |

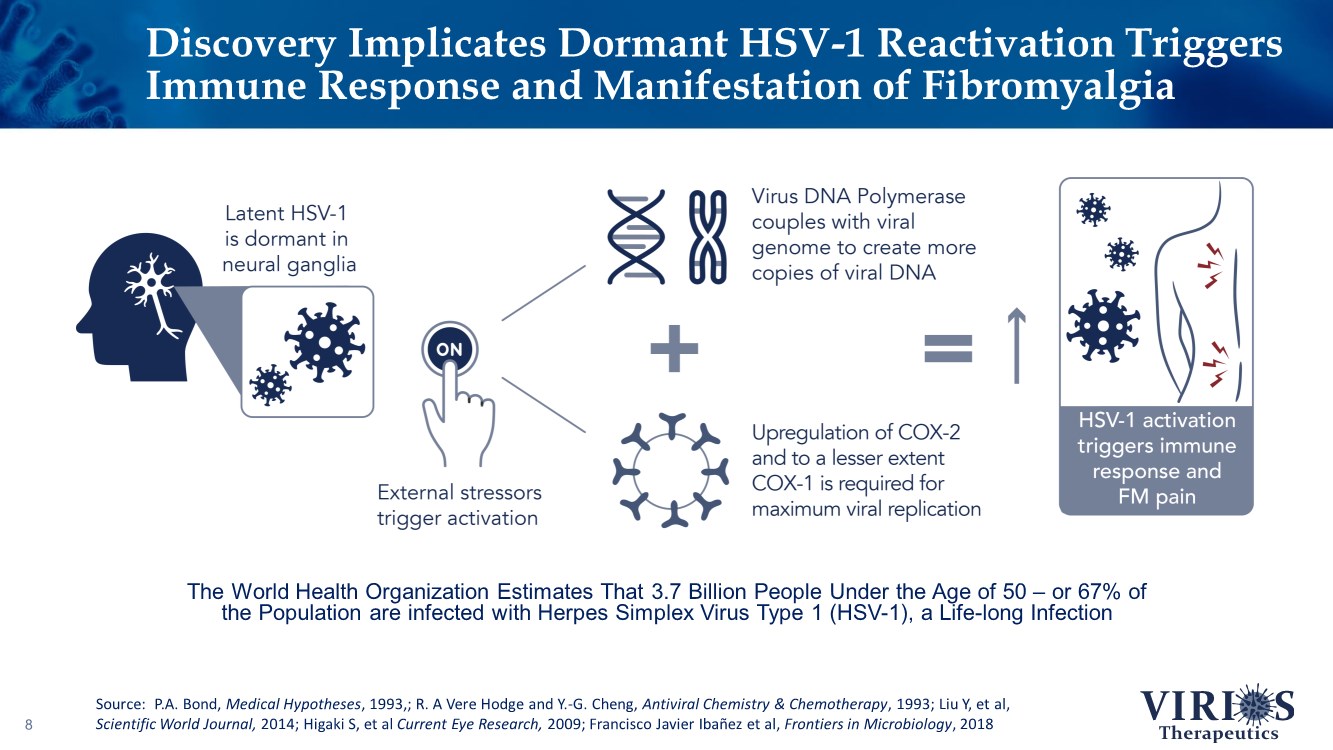

| Discovery Implicates Dormant HSV-1 Reactivation Triggers Immune Response and Manifestation of Fibromyalgia 8 The World Health Organization Estimates That 3.7 Billion People Under the Age of 50 – or 67% of the Population are infected with Herpes Simplex Virus Type 1 (HSV-1), a Life-long Infection Source: P.A. Bond, Medical Hypotheses, 1993,; R. A Vere Hodge and Y.-G. Cheng, Antiviral Chemistry & Chemotherapy, 1993; Liu Y, et al, Scientific World Journal, 2014; Higaki S, et al Current Eye Research, 2009; Francisco Javier Ibañez et al, Frontiers in Microbiology, 2018 |

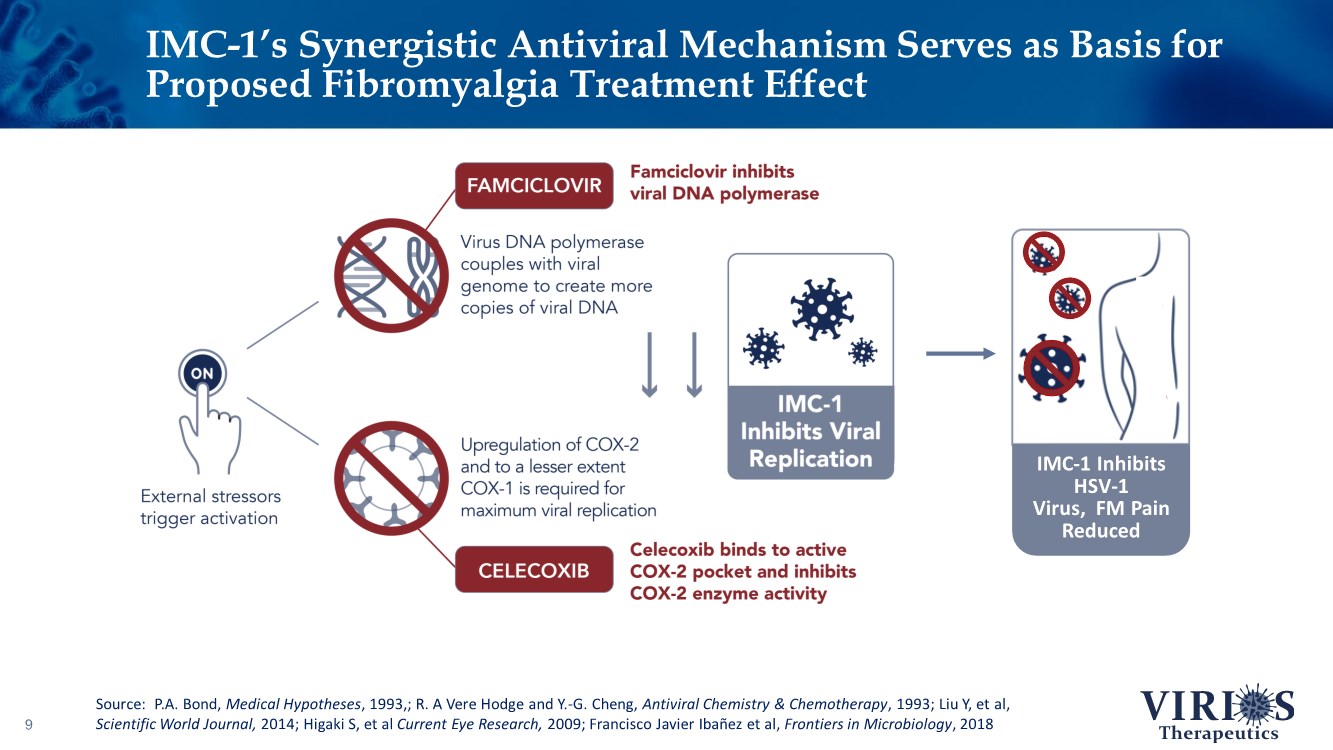

| IMC-1’s Synergistic Antiviral Mechanism Serves as Basis for Proposed Fibromyalgia Treatment Effect 9 IMC-1 Inhibits HSV-1 Virus, FM Pain Reduced Source: P.A. Bond, Medical Hypotheses, 1993,; R. A Vere Hodge and Y.-G. Cheng, Antiviral Chemistry & Chemotherapy, 1993; Liu Y, et al, Scientific World Journal, 2014; Higaki S, et al Current Eye Research, 2009; Francisco Javier Ibañez et al, Frontiers in Microbiology, 2018 |

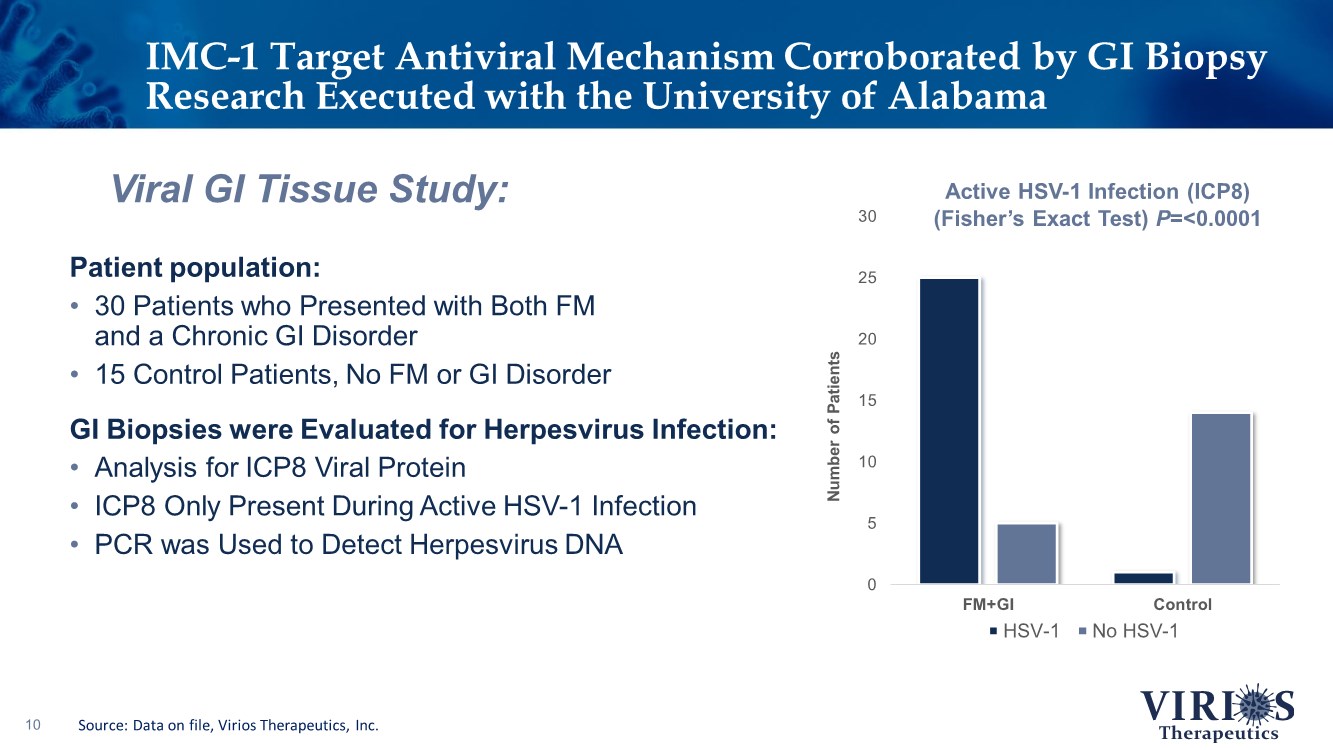

| 10 Viral GI Tissue Study: Patient population: • 30 Patients who Presented with Both FM and a Chronic GI Disorder • 15 Control Patients, No FM or GI Disorder GI Biopsies were Evaluated for Herpesvirus Infection: • Analysis for ICP8 Viral Protein • ICP8 Only Present During Active HSV-1 Infection • PCR was Used to Detect Herpesvirus DNA IMC-1 Target Antiviral Mechanism Corroborated by GI Biopsy Research Executed with the University of Alabama 0 5 10 15 20 25 30 FM+GI Control Number of Patients HSV-1 No HSV-1 Active HSV-1 Infection (ICP8) (Fisher’s Exact Test) P=<0.0001 Source: Data on file, Virios Therapeutics, Inc. |

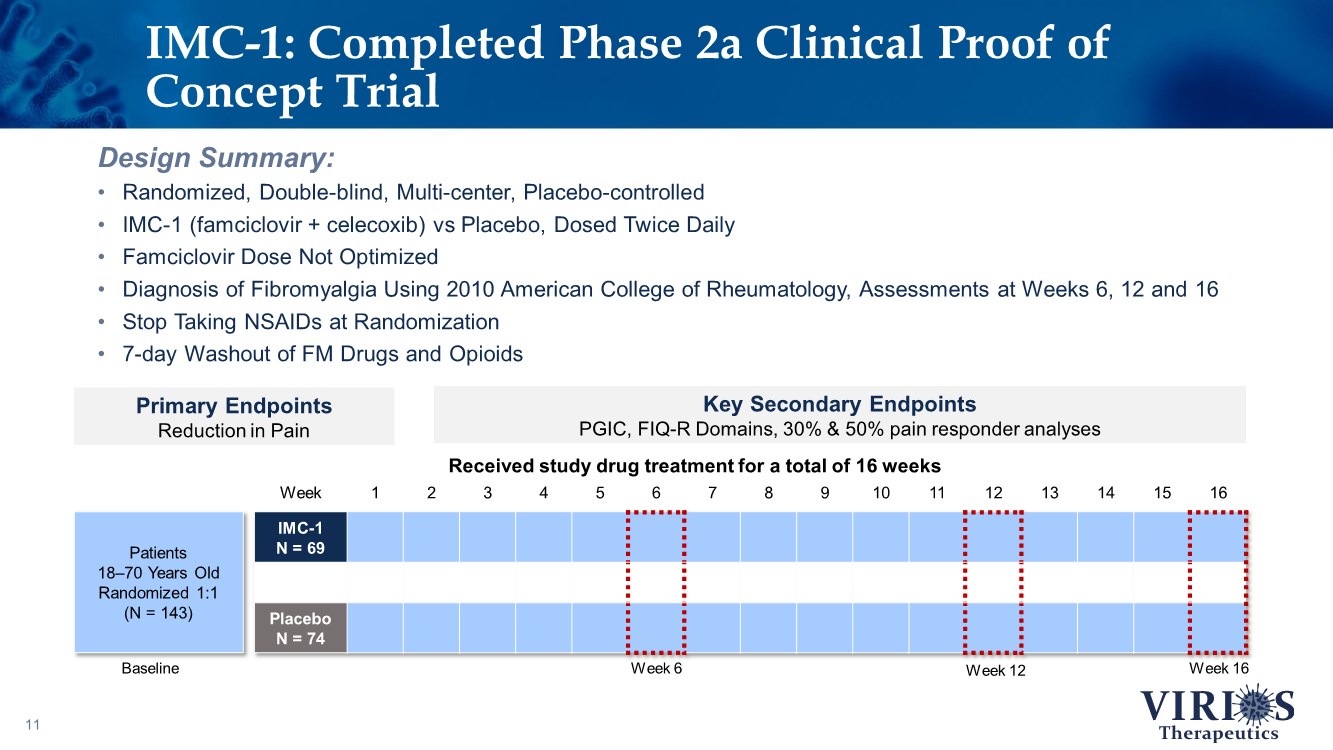

| Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 IMC-1 N = 69 Placebo N = 74 11 Design Summary: • Randomized, Double-blind, Multi-center, Placebo-controlled • IMC-1 (famciclovir + celecoxib) vs Placebo, Dosed Twice Daily • Famciclovir Dose Not Optimized • Diagnosis of Fibromyalgia Using 2010 American College of Rheumatology, Assessments at Weeks 6, 12 and 16 • Stop Taking NSAIDs at Randomization • 7-day Washout of FM Drugs and Opioids IMC-1: Completed Phase 2a Clinical Proof of Concept Trial Primary Endpoints Reduction in Pain Key Secondary Endpoints PGIC, FIQ-R Domains, 30% & 50% pain responder analyses Week 6 Week 12 Week 16 Received study drug treatment for a total of 16 weeks Baseline Patients 18–70 Years Old Randomized 1:1 (N = 143) |

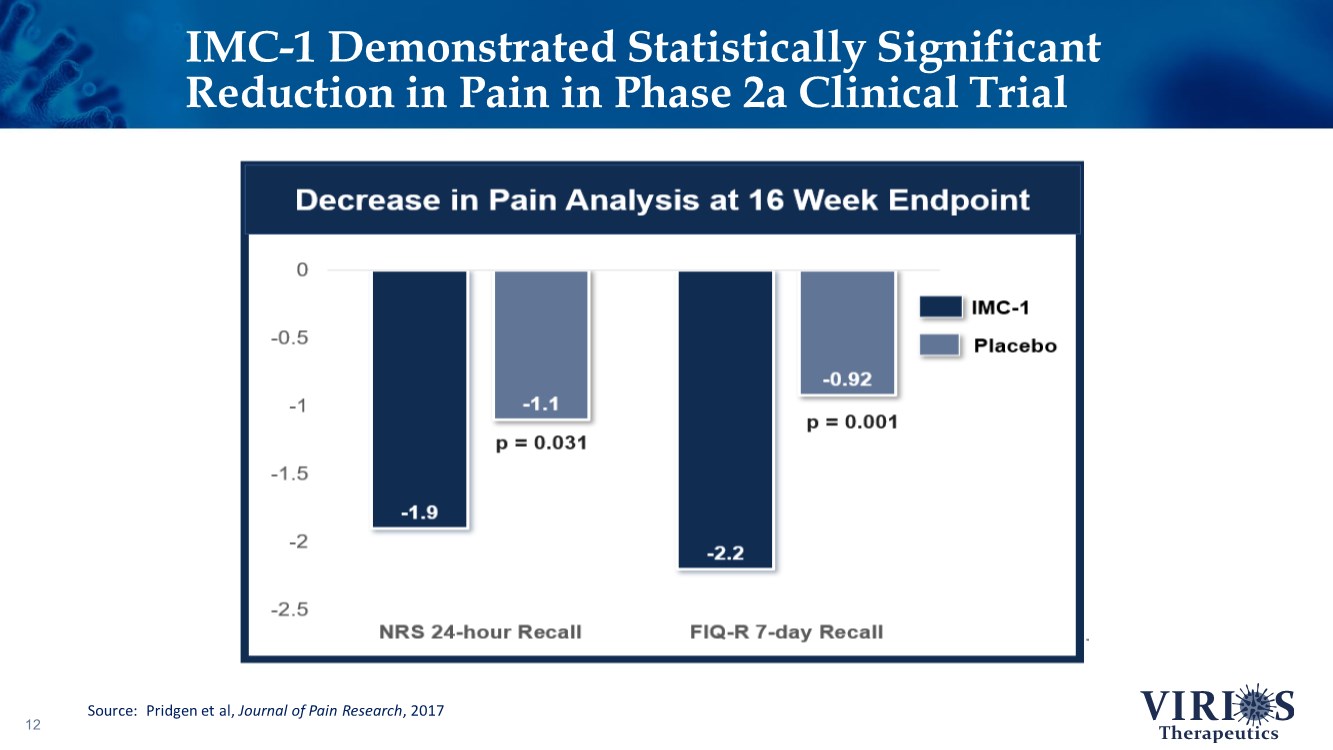

| IMC-1 Demonstrated Statistically Significant Reduction in Pain in Phase 2a Clinical Trial 12 p = 0.031 p = 0.001 Source: Pridgen et al, Journal of Pain Research, 2017 |

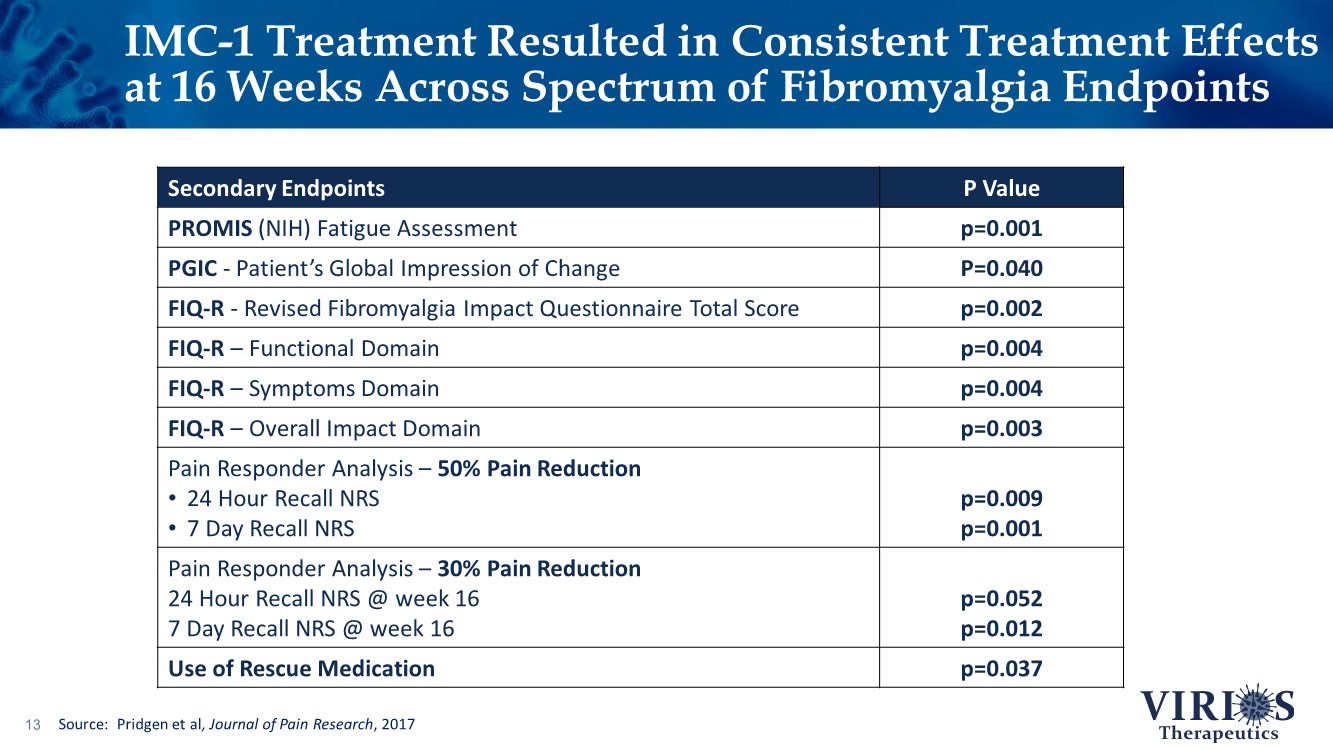

| IMC-1 Treatment Resulted in Consistent Treatment Effects at 16 Weeks Across Spectrum of Fibromyalgia Endpoints 13 Secondary Endpoints P Value PROMIS (NIH) Fatigue Assessment p=0.001 PGIC - Patient’s Global Impression of Change P=0.040 FIQ-R- Revised Fibromyalgia Impact Questionnaire Total Score p=0.002 FIQ-R – Functional Domain p=0.004 FIQ-R – Symptoms Domain p=0.004 FIQ-R – Overall Impact Domain p=0.003 Pain Responder Analysis – 50% Pain Reduction • 24 Hour Recall NRS • 7 Day Recall NRS p=0.009 p=0.001 Pain Responder Analysis – 30% Pain Reduction 24 Hour Recall NRS @ week 16 7 Day Recall NRS @ week 16 p=0.052 p=0.012 Use of Rescue Medication p=0.037 Source: Pridgen et al, Journal of Pain Research, 2017 |

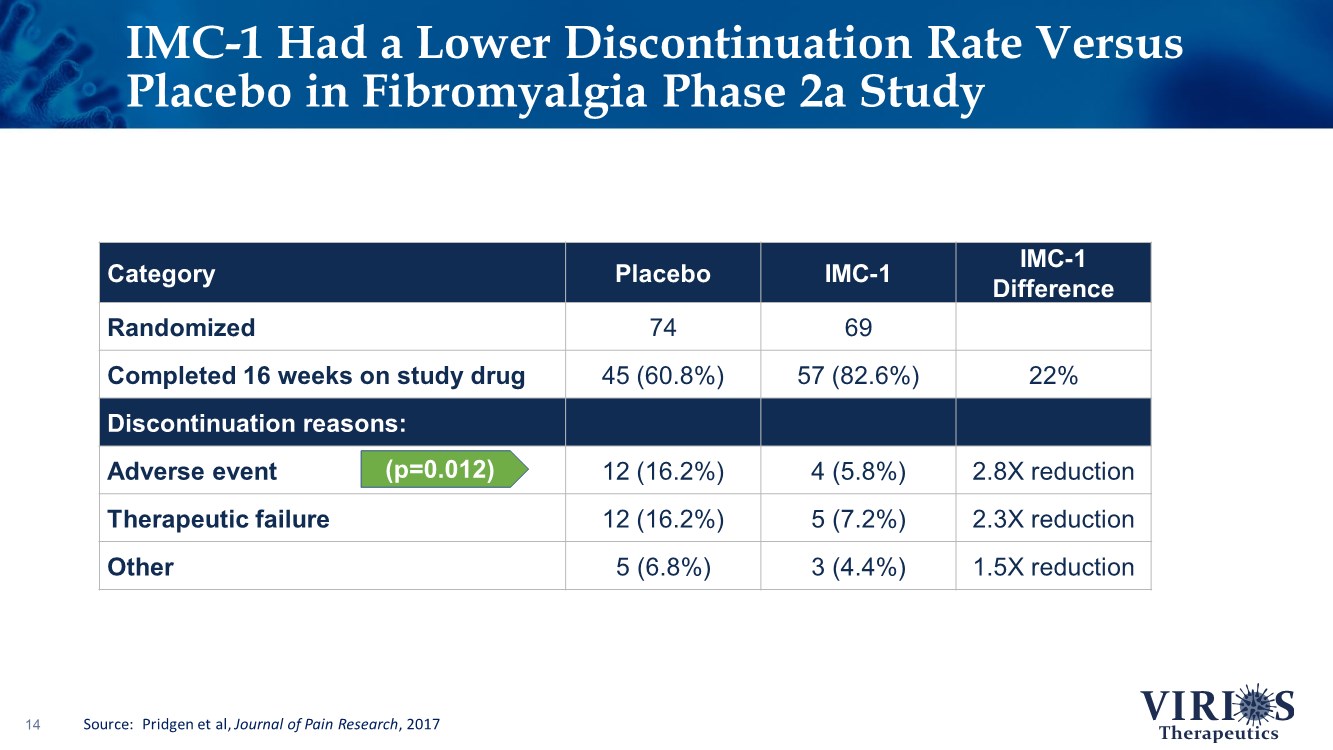

| IMC-1 Had a Lower Discontinuation Rate Versus Placebo in Fibromyalgia Phase 2a Study 14 Category Placebo IMC-1 IMC-1 Difference Randomized 74 69 Completed 16 weeks on study drug 45 (60.8%) 57 (82.6%) 22% Discontinuation reasons: Adverse event 12 (16.2%) 4 (5.8%) 2.8X reduction Therapeutic failure 12 (16.2%) 5 (7.2%) 2.3X reduction Other 5 (6.8%) 3 (4.4%) 1.5X reduction (p=0.012) Source: Pridgen et al, Journal of Pain Research, 2017 |

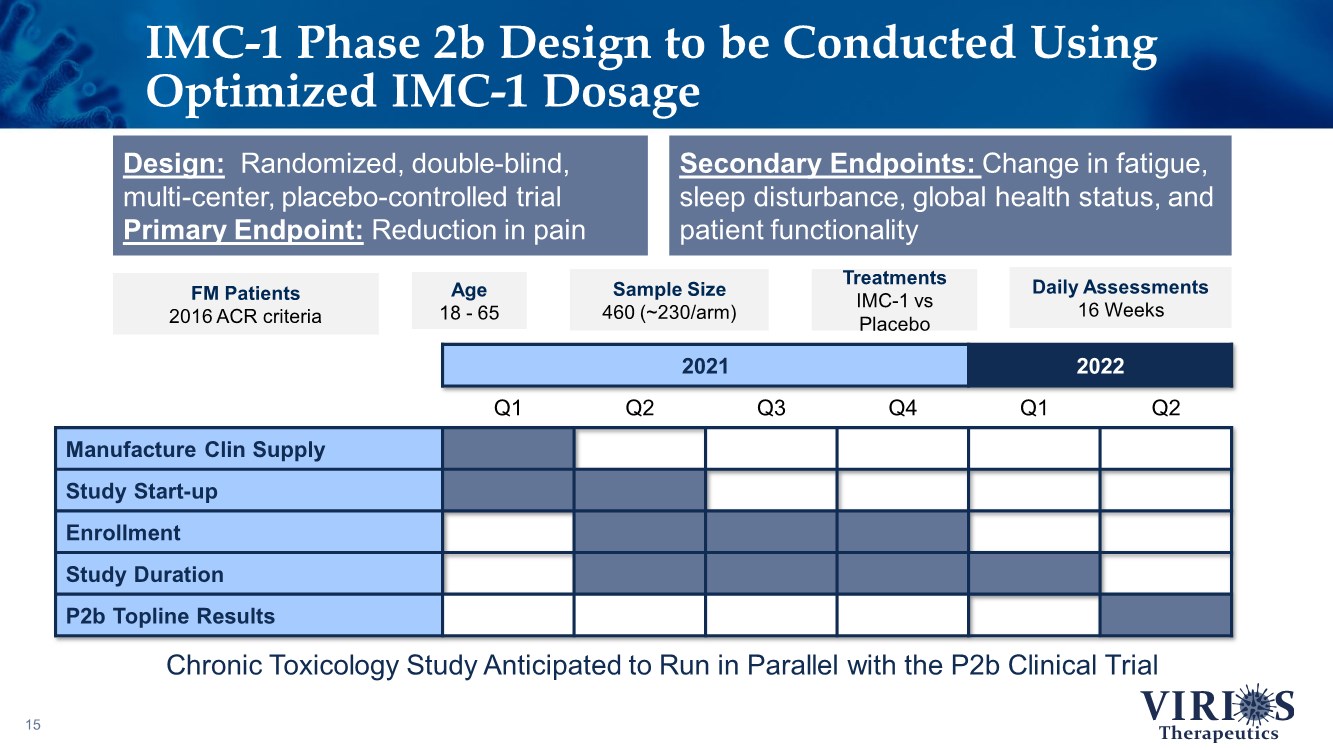

| IMC-1 Phase 2b Design to be Conducted Using Optimized IMC-1 Dosage 15 Secondary Endpoints: Change in fatigue, sleep disturbance, global health status, and patient functionality FM Patients 2016 ACR criteria Age 18 - 65 Sample Size 460 (~230/arm) Treatments IMC-1 vs Placebo Daily Assessments 16 Weeks Design: Randomized, double-blind, multi-center, placebo-controlled trial Primary Endpoint: Reduction in pain 2021 2022 Q1 Q2 Q3 Q4 Q1 Q2 Manufacture Clin Supply Study Start-up Enrollment Study Duration P2b Topline Results Chronic Toxicology Study Anticipated to Run in Parallel with the P2b Clinical Trial |

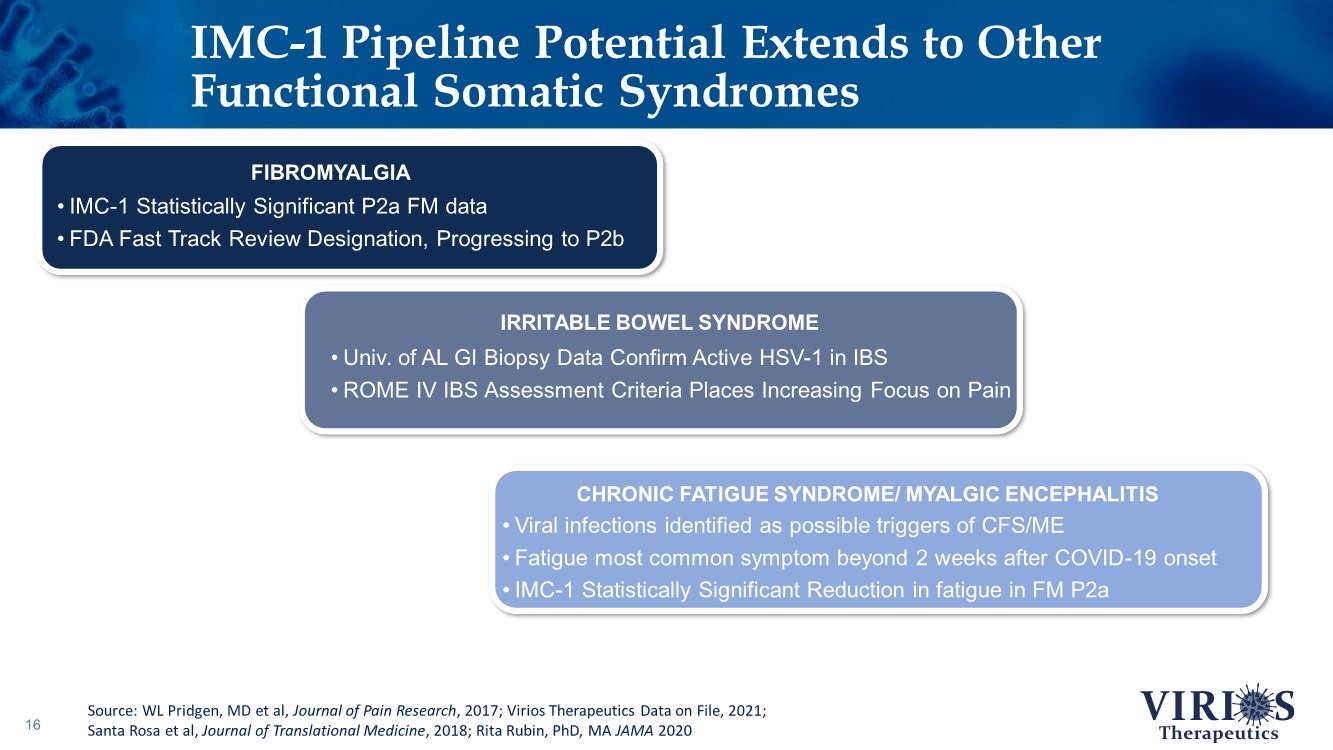

| IMC-1 Pipeline Potential Extends to Other Functional Somatic Syndromes 16 • IMC-1 Statistically Significant P2a FM data • FDA Fast Track Review Designation, Progressing to P2b FIBROMYALGIA • Univ. of AL GI Biopsy Data Confirm Active HSV-1 in IBS • ROME IV IBS Assessment Criteria Places Increasing Focus on Pain IRRITABLE BOWEL SYNDROME • Viral infections identified as possible triggers of CFS/ME • Fatigue most common symptom beyond 2 weeks after COVID-19 onset • IMC-1 Statistically Significant Reduction in fatigue in FM P2a CHRONIC FATIGUE SYNDROME/ MYALGIC ENCEPHALITIS Source: WL Pridgen, MD et al, Journal of Pain Research, 2017; Virios Therapeutics Data on File, 2021; Santa Rosa et al, Journal of Translational Medicine, 2018; Rita Rubin, PhD, MA JAMA 2020 |

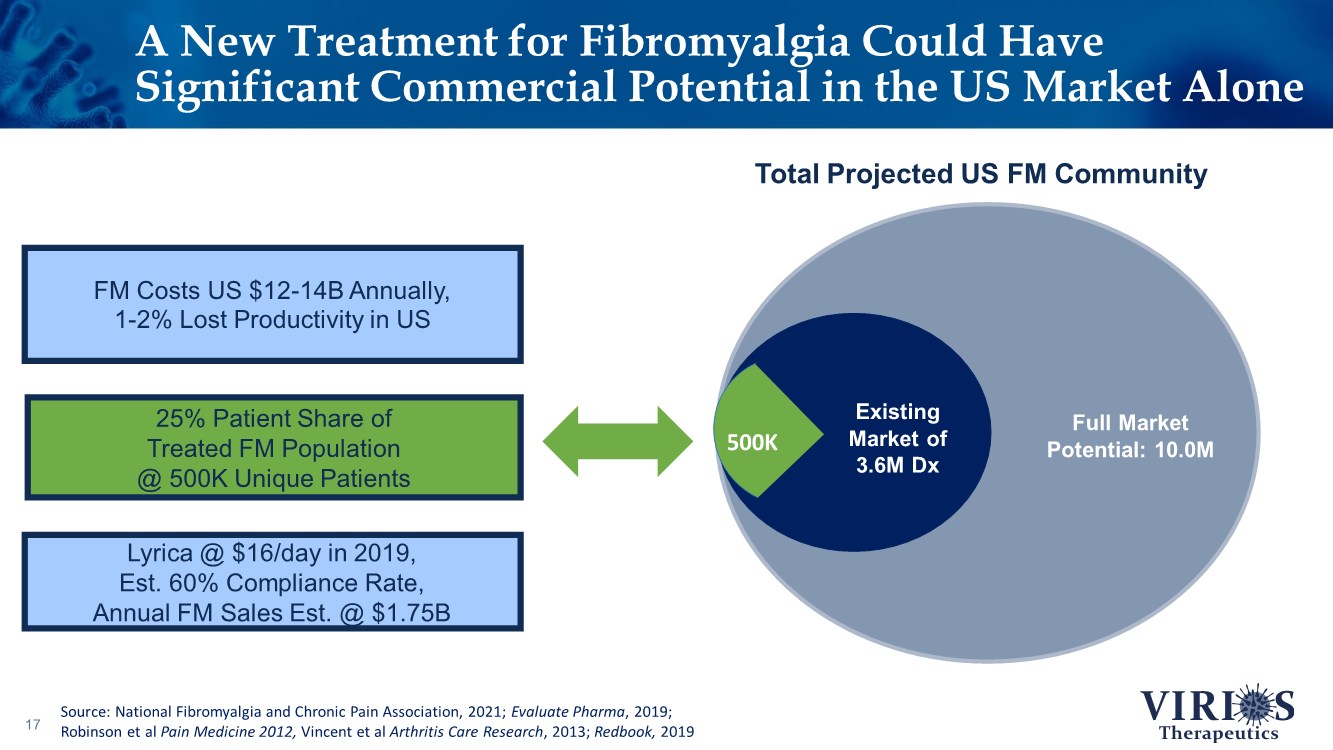

| A New Treatment for Fibromyalgia Could Have Significant Commercial Potential in the US Market Alone 17 Existing Market of 3.6M Dx Full Market Potential: 10.0M Total Projected US FM Community 500K 25% Patient Share of Treated FM Population @ 500K Unique Patients Lyrica @ $16/day in 2019, Est. 60% Compliance Rate, Annual FM Sales Est. @ $1.75B FM Costs US $12-14B Annually, 1-2% Lost Productivity in US Source: National Fibromyalgia and Chronic Pain Association, 2021; Evaluate Pharma, 2019; Robinson et al Pain Medicine 2012, Vincent et al Arthritis Care Research, 2013; Redbook, 2019 |

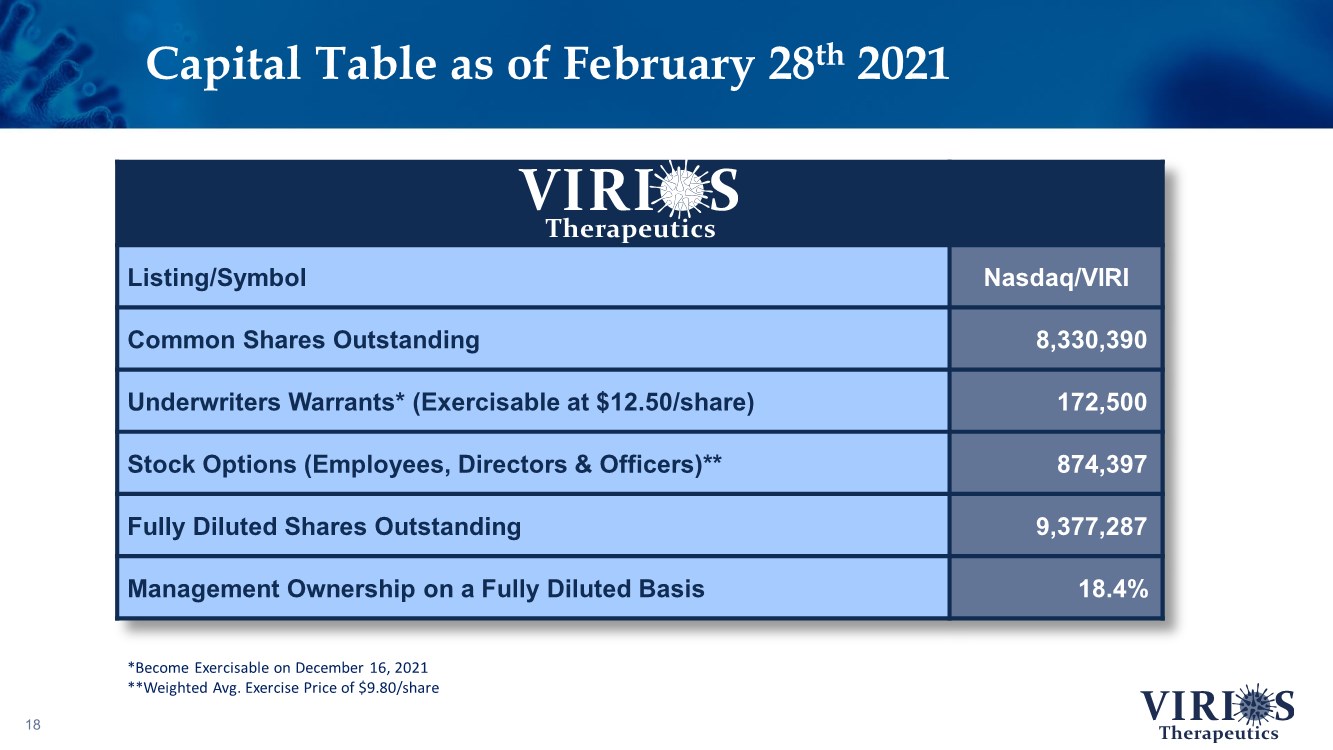

| Capital Table as of February 28th 2021 18 Listing/Symbol Nasdaq/VIRI Common Shares Outstanding 8,330,390 Underwriters Warrants* (Exercisable at $12.50/share) 172,500 Stock Options (Employees, Directors & Officers)** 874,397 Fully Diluted Shares Outstanding 9,377,287 Management Ownership on a Fully Diluted Basis 18.4% *Become Exercisable on December 16, 2021 **Weighted Avg. Exercise Price of $9.80/share |

| Virios Therapeutics Summary 19 Virios Team and Board of Directors Have Deep Experience in Developing and Commercializing FM and Antiviral Medicines The FM Market is Large, but Dissatisfied – Significant Commercial Potential for Differentiated New FM Treatment Unique IMC-1 Antiviral Combination (famciclovir & celecoxib) Garnered FDA Fastrack Review Designation, Patent Coverage Until 2033 Positive IMC-1 P2b Results in Q2 ‘22 Could Transform FM Patient Care Our Lead Asset, Oral IMC-1, Demonstrated Significant FM Pain Reduction and Tolerability Benefits in Phase 2a Clinical Trial |