| New Scientific Paradigm Exploring Herpes Virus Activation as Potential Underlying Cause of Fibromyalgia, Long COVID and Other Chronic Conditions Nasdaq: VIRI November 2022 |

| NASDAQ: VIRI Forward Looking Statements 2 • Statements in this presentation contain “forward - looking statements” that are subject to substantial risks and uncertainties. Fo rward - looking statements contained in this presentation may be identified by the use of words such as “anticipate,” “expect,” “believe,” “will,” “may,” “should,” “estimate,” “project,” “ou tlo ok,” “forecast” or other similar words, and include, without limitation, all statements other than those regarding historical facts, statements regarding Virios Therapeutics, Inc.’s expectations regardi ng our future financial or business performance, plans, prospects, trends or strategies, objectives of management, competition and other financial and business matters; the potential, safety, eff icacy, and regulatory and clinical progress of our current and prospective product candidates, planned clinical trials and preclinical activities, and projected research and development costs ; the estimated size of the market for our product candidates; and the timing and success of our development and commercialization of our anticipated product candidates and the market acceptance thereof. Forward - looking statements are based on our current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, ce rtain forward - looking statements are based on assumptions as to future events that may not prove to be accurate. These statements are neither promises nor guarantees, but involve known and unk nown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or ach ievements expressed or implied by the forward - looking statements, including, but not limited to, the following: the ongoing effects of COVID - 19 has adversely impacted and may continu e to adversely impact our business, including our preclinical studies and clinical trials; our limited operating history, which may make it difficult to evaluate our current business and pre dict our future success and viability; we have and expect to continue to incur significant losses; our need for additional funding, which may not be available; our substantial dependence on the succ ess of our lead product candidates; failure to identify additional product candidates and develop or commercialize marketable products; the early stage of our development efforts; potential un for eseen events during clinical trials could cause delays or other adverse consequences; risks relating to the regulatory approval process or ongoing regulatory obligations; our product candid ate s may cause serious adverse side effects; our reliance on third parties; effects of significant competition; the possibility of system failures or security breaches; risks relating to intel lec tual property; our ability to attract, retain and motivate qualified personnel; and significant costs as a result of operating as a public company. These and other risks and uncertainties are de scr ibed more fully in the section titled “Risk Factors” in the Annual Report on Form 10 - K for the year ended December 31, 2021 filed with the Securities and Exchange Commission (“SEC”) and elsewhere in our filings and reports with the SEC. While we may elect to update these forward - looking statements at some point in the future, we assume no obligation to update or revise any fo rward - looking statements except to the extent required by applicable law. Although we believe the expectations reflected in such forward - looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Accordingly, readers are cautioned not to place undue reliance on these forward - looking statements. No representations or warran ties (expressed or implied) are made about the accuracy of any such forward - looking statements. • This presentation also contains estimates and other statistical data made by independent parties and by us relating to market si ze and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such data and estimates. In addition, p rojections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncerta int y and risk. Neither we nor our affiliates, advisors or representatives makes any representation as to the accuracy or completeness of that data or undertake to update such data aft er the date of this presentation. • You should read the documents that we have filed with the SEC for more complete information about us. We encourage you to rea d s uch documents in full for more detailed information on statistics, reports and clinical trials referenced in this presentation. You may access these documents for free by visiting ED GAR on the SEC website at http://www.sec.gov. |

| NASDAQ: VIRI Proven Leadership Team with Extensive Experience in Drug Development and Commercialization 3 Pharma Brand Development & Commercialization Experience Includes Management of: Greg Duncan Chairman & CEO R. Michael Gendreau MD, PhD CMO Ralph Grosswald SVP of Operations Angela Walsh SVP of Finance EXECUTIVE TEAM DIRECTORS Rich Whitley, MD • Distinguished Professor, UAB • Remdesivir was Originally Developed by Dr. Whitley’s team at UAB • DSMB Chair, Operation Warp Speed Abel De La Rosa, PhD • Chairman, Co - Founder Anitos Therapeutics • Led Bus Dev for Pharmasset acquisition by GILD for $11.5 billion in 2012 • Leadership for Development Programs for the Treatment of HIV, Hepatitis B & C, including Sofosbuvir John Thomas, CPA • CorMatrix Inc., MiMedx Group, Inc., DARA BioSciences , GMP Companies • MRI Interventions, EnterMed , Inc., • Medicis Pharm Corp., CytRx Corp Rick Keefer • 30 - year Pharma industry veteran with broad - based experience in leading commercial operations • Executive roles at Pharmacia, Pfizer, Wyeth, Biovail and Publicis Health • Seven - time winner of Pharma Voice’s top 100 healthcare leaders Rick Burch • 30 years at PFE including SVP • VP and GM UCB Pharmaceuticals • Former President of VIRI, Inc. • Product launches include Lyrica & Celebrex Skip Pridgen, MD VIRI Founder • Company Founder • Board - certified surgeon practicing with Tuscaloosa Surgical Associates, P.C. • Served as a physician and surgeon in the U.S. Navy |

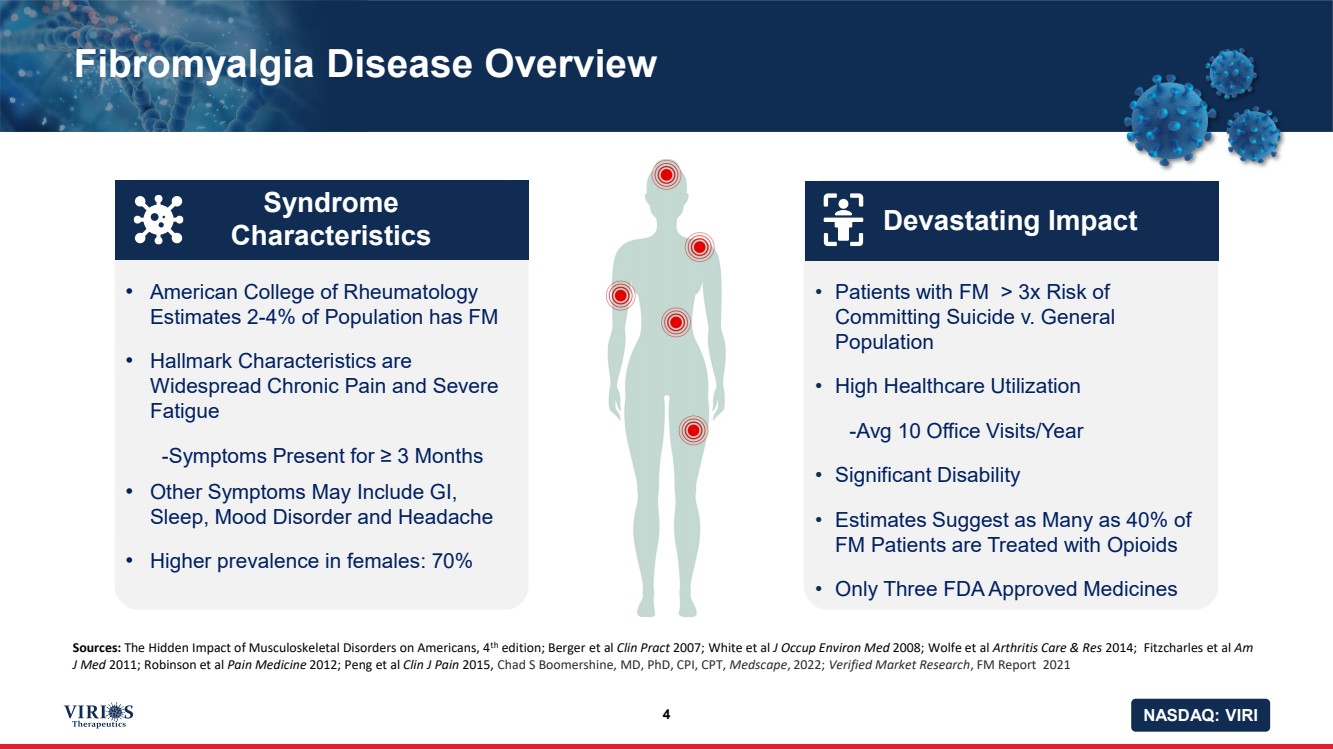

| NASDAQ: VIRI Fibromyalgia Disease Overview 4 • American College of Rheumatology Estimates 2 - 4% of Population has FM • Hallmark Characteristics are Widespread Chronic Pain and Severe Fatigue - Symptoms Present for ≥ 3 Months • Other Symptoms May Include GI, Sleep, Mood Disorder and Headache • Higher prevalence in females: 70% Syndrome Characteristics Sources: The Hidden Impact of Musculoskeletal Disorders on Americans, 4 th edition; Berger et al Clin Pract 2007; White et al J Occup Environ Med 2008; Wolfe et al Arthritis Care & Res 2014; Fitzcharles et al Am J Med 2011; Robinson et al Pain Medicine 2012; Peng et al Clin J Pain 2015, Chad S Boomershine , MD, PhD, CPI, CPT, Medscape , 2022; Verified Market Research , FM Report 2021 • Patients with FM > 3x Risk of Committing Suicide v. General Population • High Healthcare Utilization - Avg 10 Office Visits/Year • Significant Disability • Estimates Suggest as Many as 40% of FM Patients are Treated with Opioids • Only Three FDA Approved Medicines Devastating Impact |

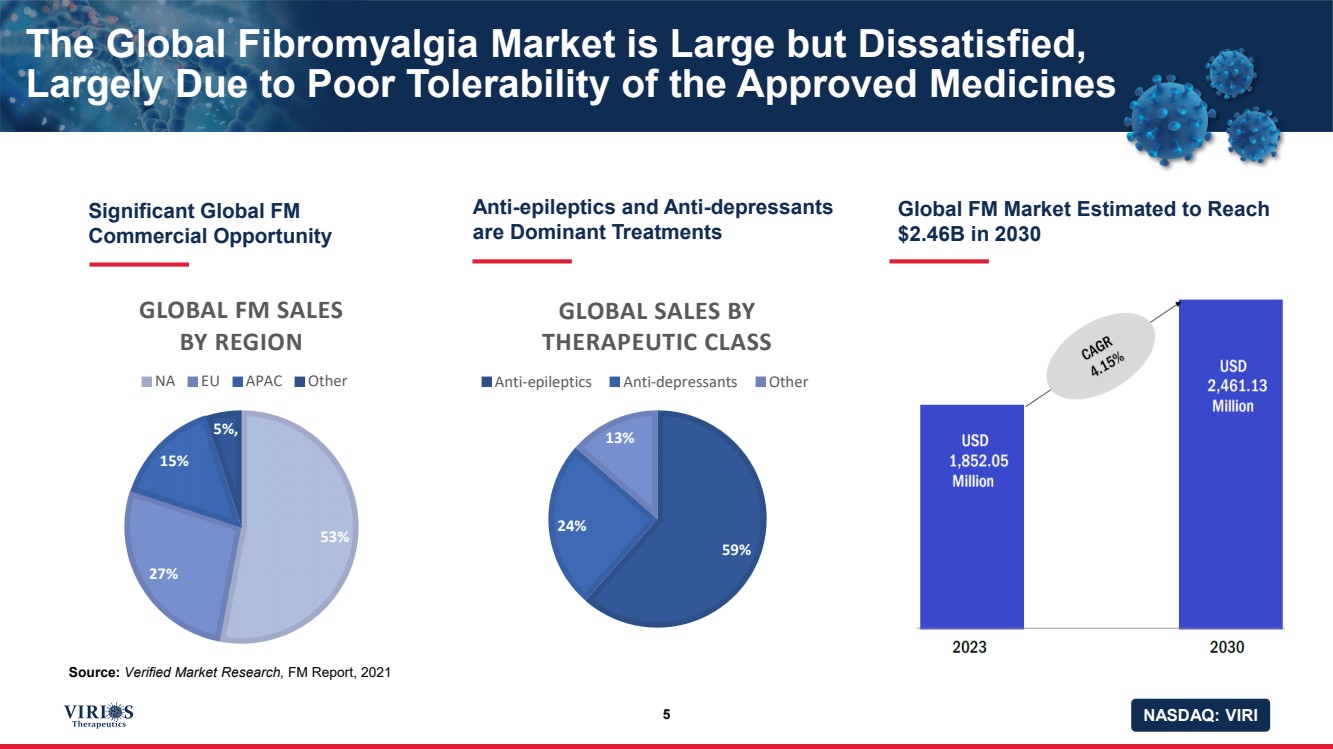

| NASDAQ: VIRI The Global Fibromyalgia Market is Large but Dissatisfied, Largely Due to Poor Tolerability of the Approved Medicines 5 Significant Global FM Commercial Opportunity Source: Verified Market Research, FM Report, 2021 Anti - epileptics and Anti - depressants are Dominant Treatments Global FM Market Estimated to Reach $2.46B in 2030 75% 25% 59% 24% 13% GLOBAL SALES BY THERAPEUTIC CLASS Anti-epileptics Anti-depressants Other 53% 27% 15% 5% , GLOBAL FM SALES BY REGION NA EU APAC Other |

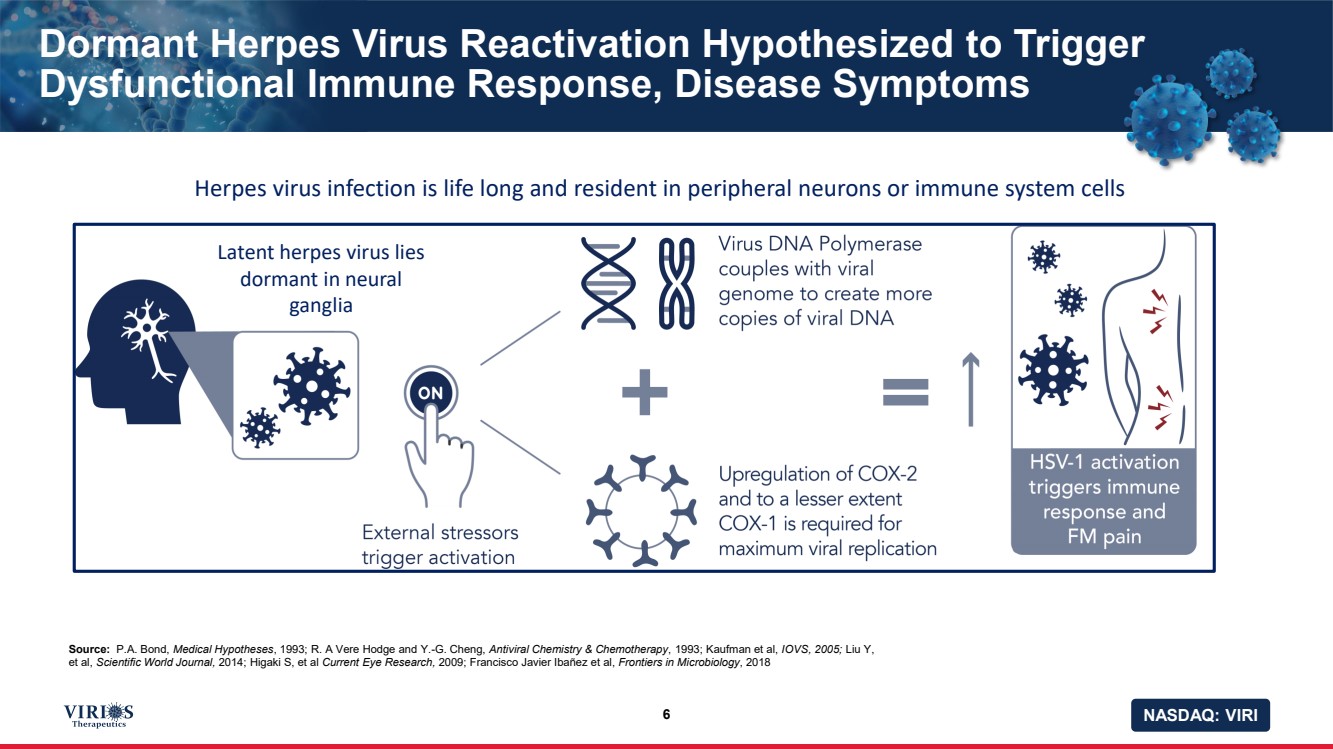

| NASDAQ: VIRI Dormant Herpes Virus Reactivation Hypothesized to Trigger Dysfunctional Immune Response, Disease Symptoms 6 Source: P.A. Bond, Medical Hypotheses , 1993; R. A Vere Hodge and Y. - G. Cheng, Antiviral Chemistry & Chemotherapy , 1993; Kaufman et al, IOVS, 2005; Liu Y, et al, Scientific World Journal, 2014; Higaki S, et al Current Eye Research, 2009; Francisco Javier Ibañez et al, Frontiers in Microbiology , 2018 Latent herpes virus lies dormant in neural ganglia Herpes virus infection is life long and resident in peripheral neurons or immune system cells |

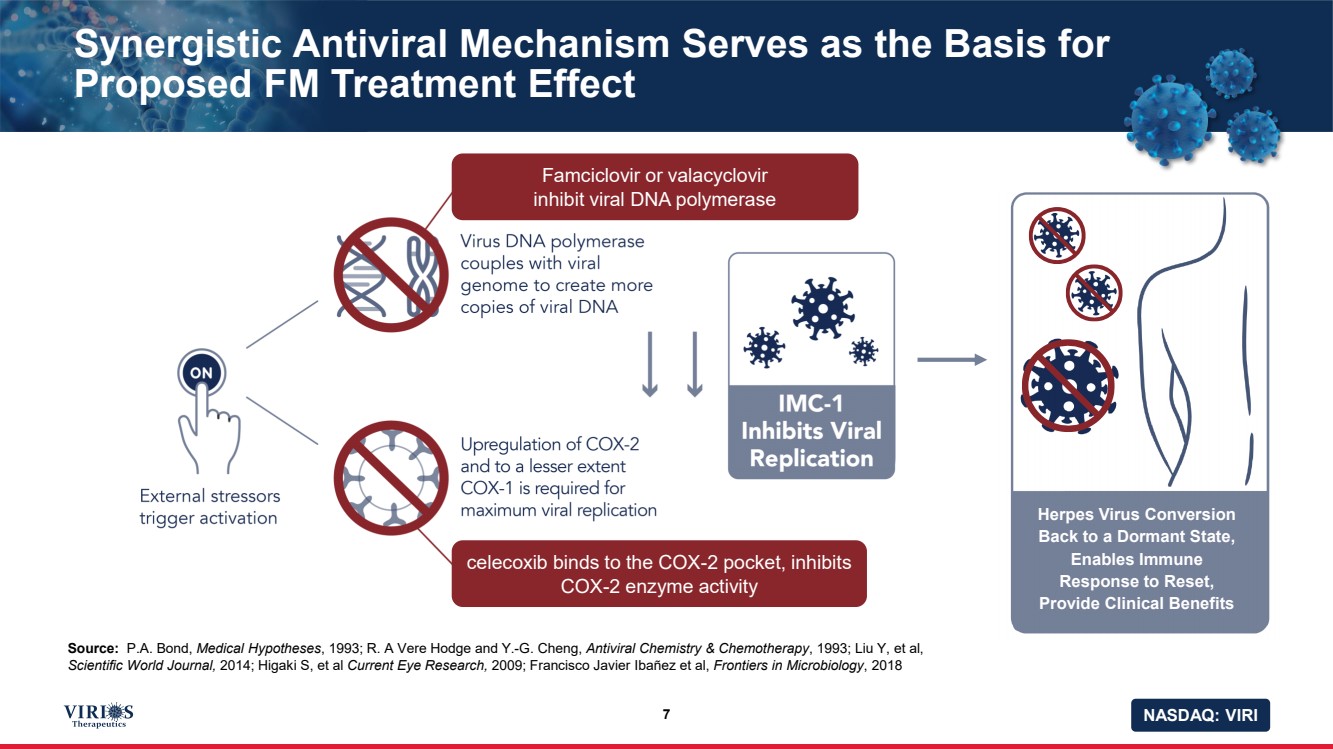

| NASDAQ: VIRI Synergistic Antiviral Mechanism Serves as the Basis for Proposed FM Treatment Effect 7 Source: P.A. Bond, Medical Hypotheses , 1993; R. A Vere Hodge and Y. - G. Cheng, Antiviral Chemistry & Chemotherapy , 1993; Liu Y, et al, Scientific World Journal, 2014; Higaki S, et al Current Eye Research, 2009; Francisco Javier Ibañez et al, Frontiers in Microbiology , 2018 Famciclovir or valacyclovir inhibit viral DNA polymerase celecoxib binds to the COX - 2 pocket, inhibits COX - 2 enzyme activity Herpes Virus Conversion Back to a Dormant State, Enables Immune Response to Reset, Provide Clinical Benefits |

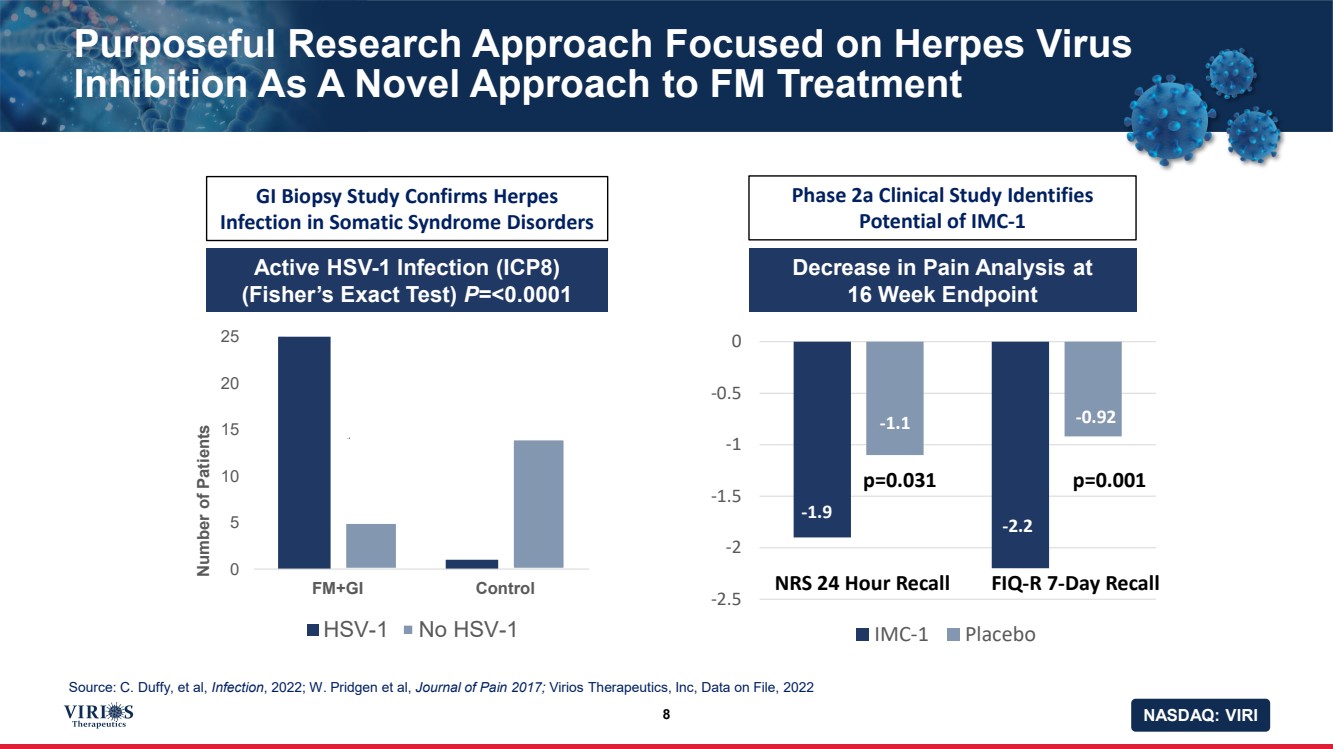

| NASDAQ: VIRI Purposeful Research Approach Focused on Herpes Virus Inhibition As A Novel Approach to FM Treatment 8 GI Biopsy Study Confirms Herpes Infection in Somatic Syndrome Disorders Phase 2a Clinical Study Identifies Potential of IMC - 1 Source: C. Duffy, et al, Infection , 2022; W. Pridgen et al, Journal of Pain 2017; Virios Therapeutics, Inc, Data on File, 2022 0 5 10 15 20 25 FM+GI Control Number of Patients HSV-1 No HSV-1 Active HSV - 1 Infection (ICP8) (Fisher’s Exact Test) P =<0.0001 - 1.9 - 2.2 - 1.1 - 0.92 -2.5 -2 -1.5 -1 -0.5 0 IMC-1 Placebo p=0.031 p=0.001 NRS 24 Hour Recall FIQ - R 7 - Day Recall Decrease in Pain Analysis at 16 Week Endpoint |

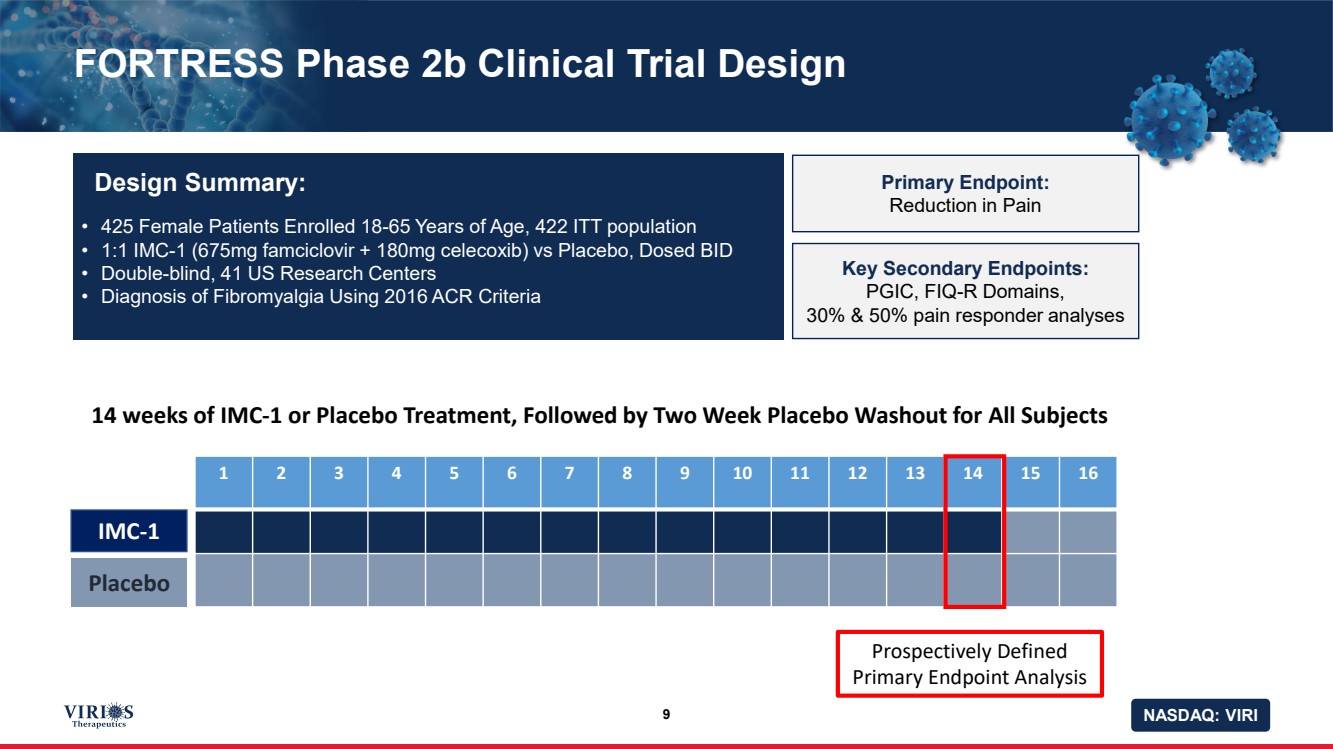

| NASDAQ: VIRI FORTRESS Phase 2b Clinical Trial Design 9 • 425 Female Patients Enrolled 18 - 65 Years of Age, 422 ITT population • 1:1 IMC - 1 (675mg famciclovir + 180mg celecoxib) vs Placebo, Dosed BID • Double - blind, 41 US Research Centers • Diagnosis of Fibromyalgia Using 2016 ACR Criteria Design Summary: Primary Endpoint: Reduction in Pain Key Secondary Endpoints: PGIC, FIQ - R Domains, 30% & 50% pain responder analyses 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 14 weeks of IMC - 1 or Placebo Treatment, Followed by Two Week Placebo Washout for All Subjects IMC - 1 Placebo Prospectively Defined Primary Endpoint Analysis |

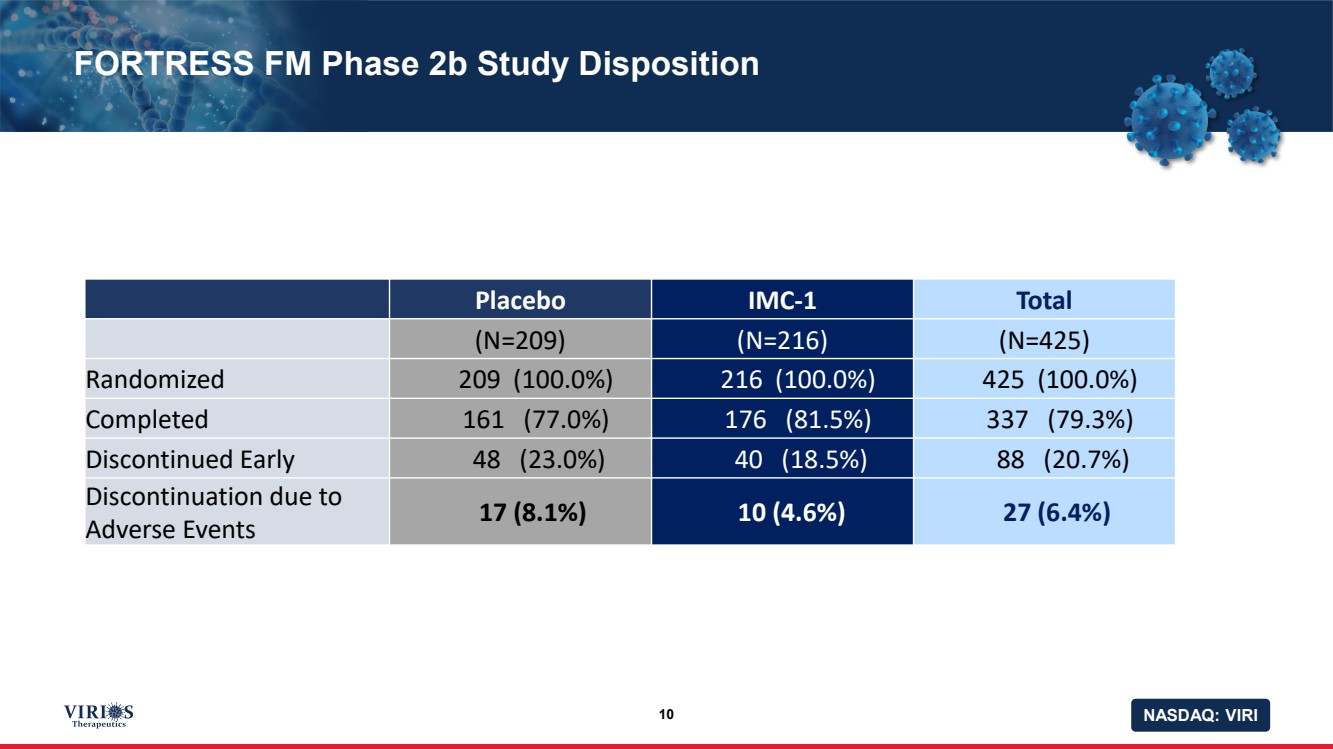

| NASDAQ: VIRI FORTRESS FM Phase 2b Study Disposition 10 Placebo IMC - 1 Total (N=209) (N=216) (N=425) Randomized 209 (100.0%) 216 (100.0%) 425 (100.0%) Completed 161 (77.0%) 176 (81.5%) 337 (79.3%) Discontinued Early 48 (23.0%) 40 (18.5%) 88 (20.7%) Discontinuation due to Adverse Events 17 (8.1%) 10 (4.6%) 27 (6.4%) |

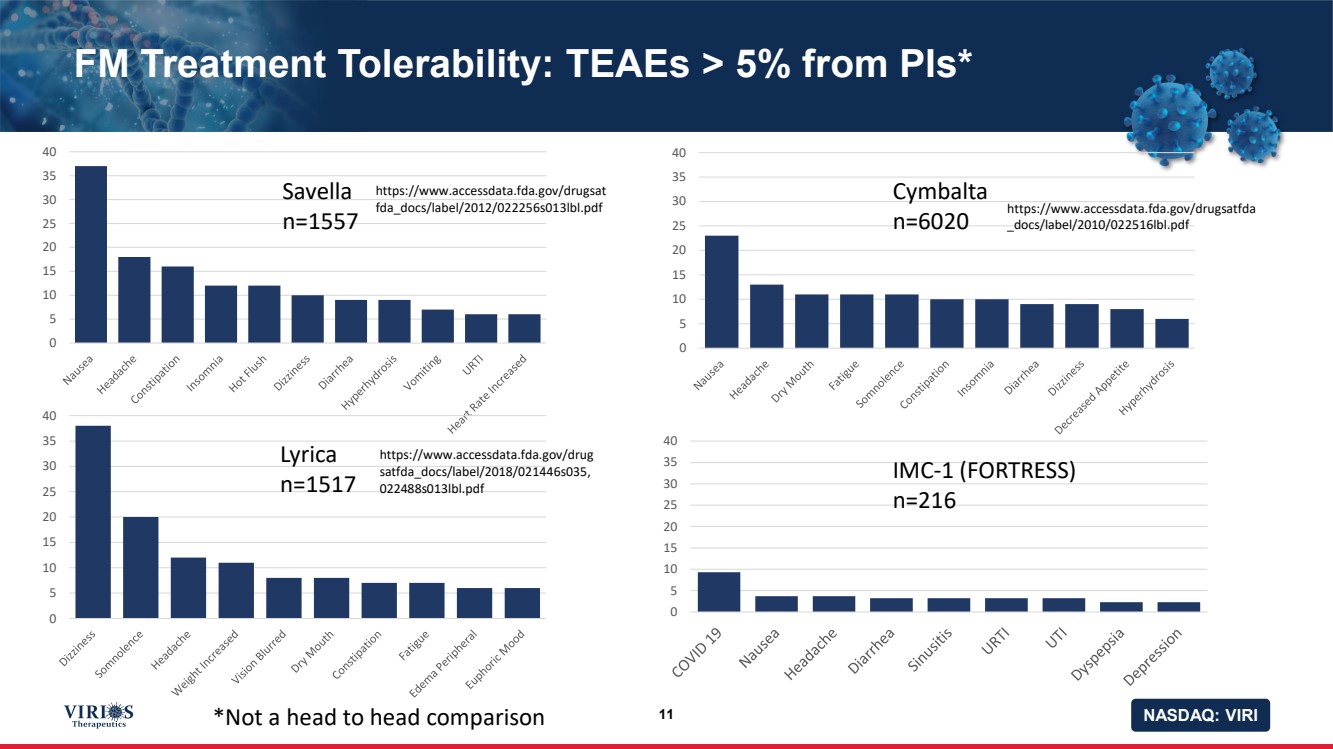

| NASDAQ: VIRI FM Treatment Tolerability: TEAEs > 5% from PIs* 11 0 5 10 15 20 25 30 35 40 0 5 10 15 20 25 30 35 40 0 5 10 15 20 25 30 35 40 0 5 10 15 20 25 30 35 40 Savella n=1557 Cymbalta n=6020 Lyrica n=1517 IMC - 1 (FORTRESS) n=216 https://www.accessdata.fda.gov/drugsat fda_docs/label/2012/022256s013lbl.pdf https://www.accessdata.fda.gov/drugsatfda _docs/label/2010/022516lbl.pdf https://www.accessdata.fda.gov/drug satfda_docs/label/2018/021446s035, 022488s013lbl.pdf *Not a head to head comparison |

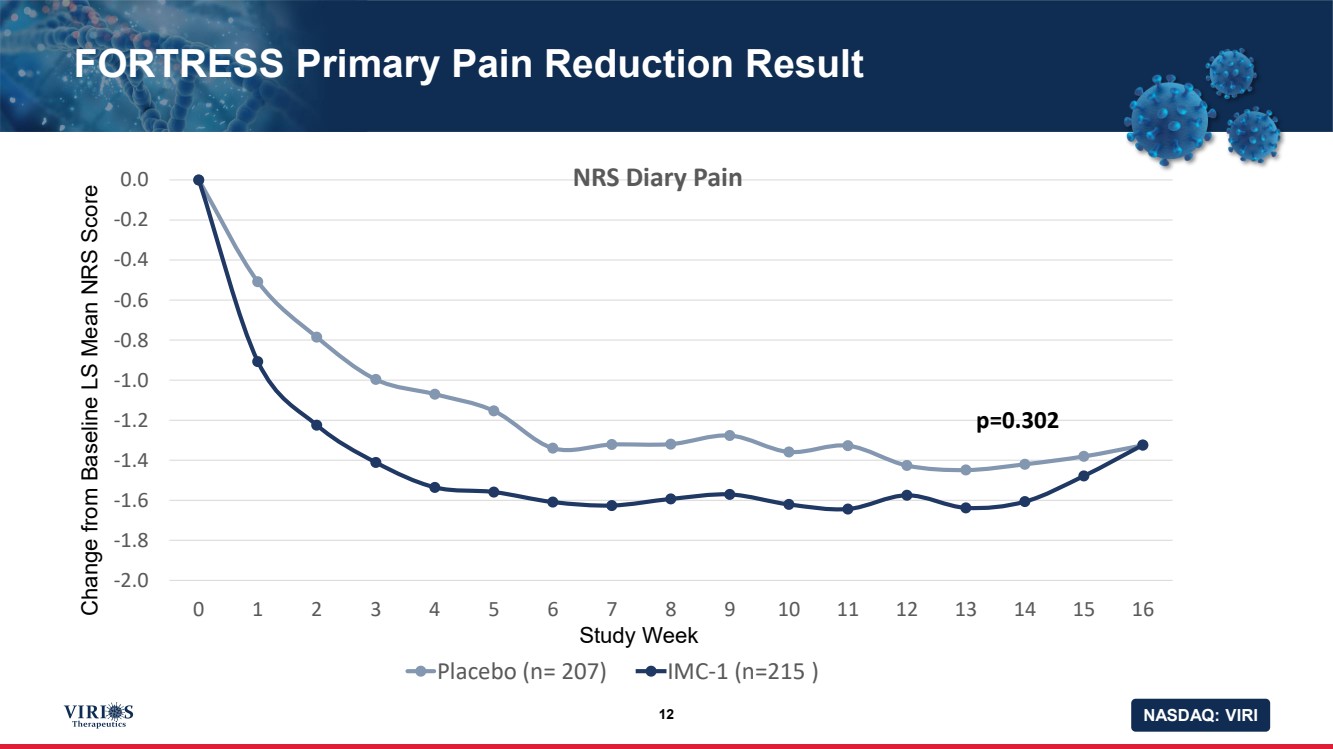

| NASDAQ: VIRI -2.0 -1.8 -1.6 -1.4 -1.2 -1.0 -0.8 -0.6 -0.4 -0.2 0.0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 NRS Diary Pain Placebo (n= 207) IMC-1 (n=215 ) FORTRESS Primary Pain Reduction Result 12 Change from Baseline LS Mean NRS Score Study Week p=0.302 |

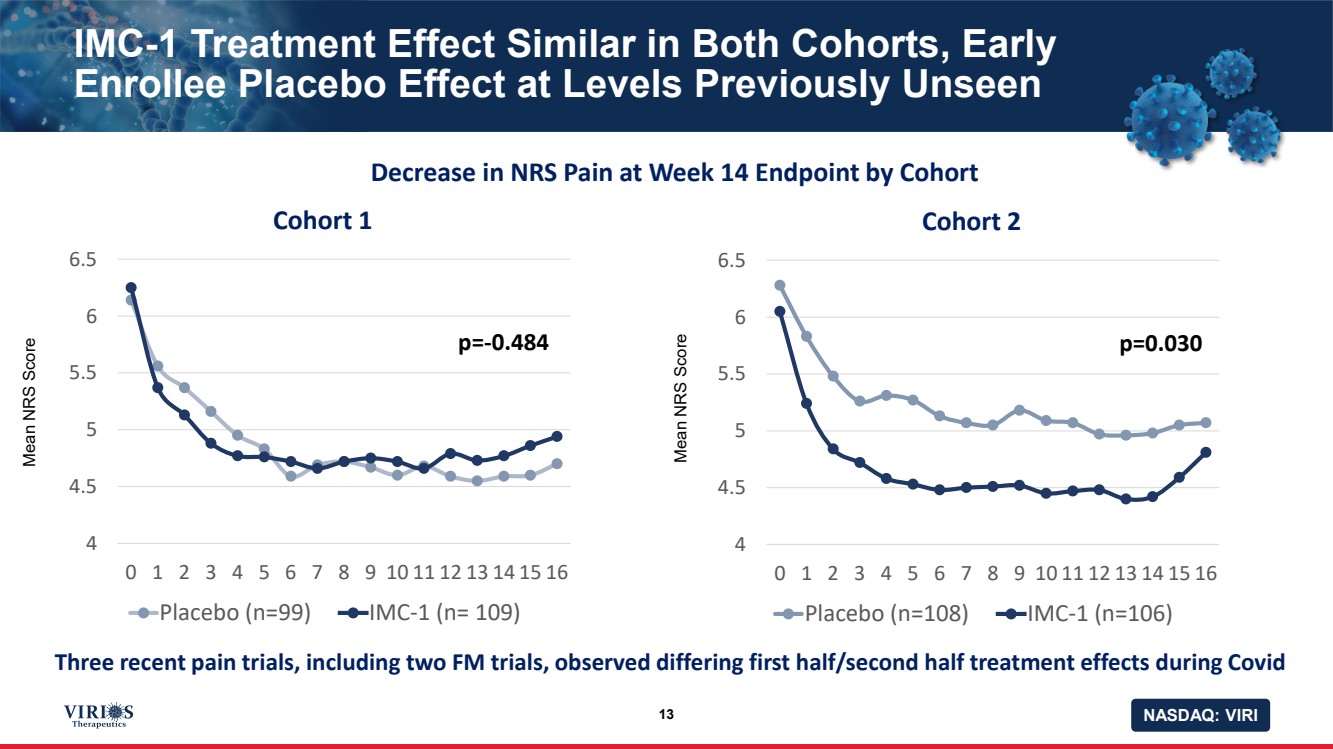

| NASDAQ: VIRI IMC - 1 Treatment Effect Similar in Both Cohorts, Early Enrollee Placebo Effect at Levels Previously Unseen 13 4 4.5 5 5.5 6 6.5 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Cohort 2 Placebo (n=108) IMC-1 (n=106) p=0.030 4 4.5 5 5.5 6 6.5 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Cohort 1 Placebo (n=99) IMC-1 (n= 109) p= - 0.484 Mean NRS Score Mean NRS Score Decrease in NRS Pain at Week 14 Endpoint by Cohort Three recent pain trials, including two FM trials, observed differing first half/second half treatment effects during Covid |

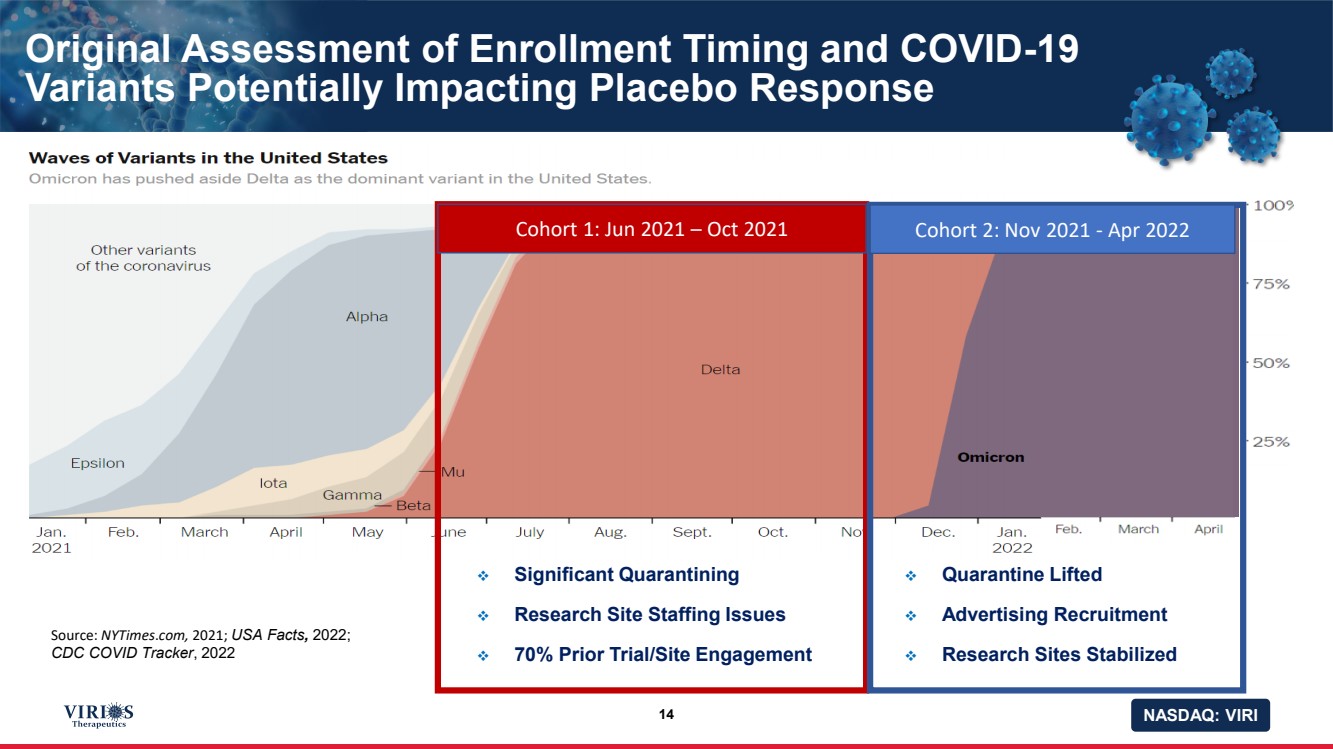

| NASDAQ: VIRI Original Assessment of Enrollment Timing and COVID - 19 Variants Potentially Impacting Placebo Response 14 Source: NYTimes .. com, 2021; USA Facts , 2022; CDC COVID Tracker , 2022 Cohort 1: Jun 2021 – Oct 2021 Cohort 2: Nov 2021 - Apr 2022 ❖ Significant Quarantining ❖ Research Site Staffing Issues ❖ 70% Prior Trial/Site Engagement ❖ Quarantine Lifted ❖ Advertising Recruitment ❖ Research Sites Stabilized |

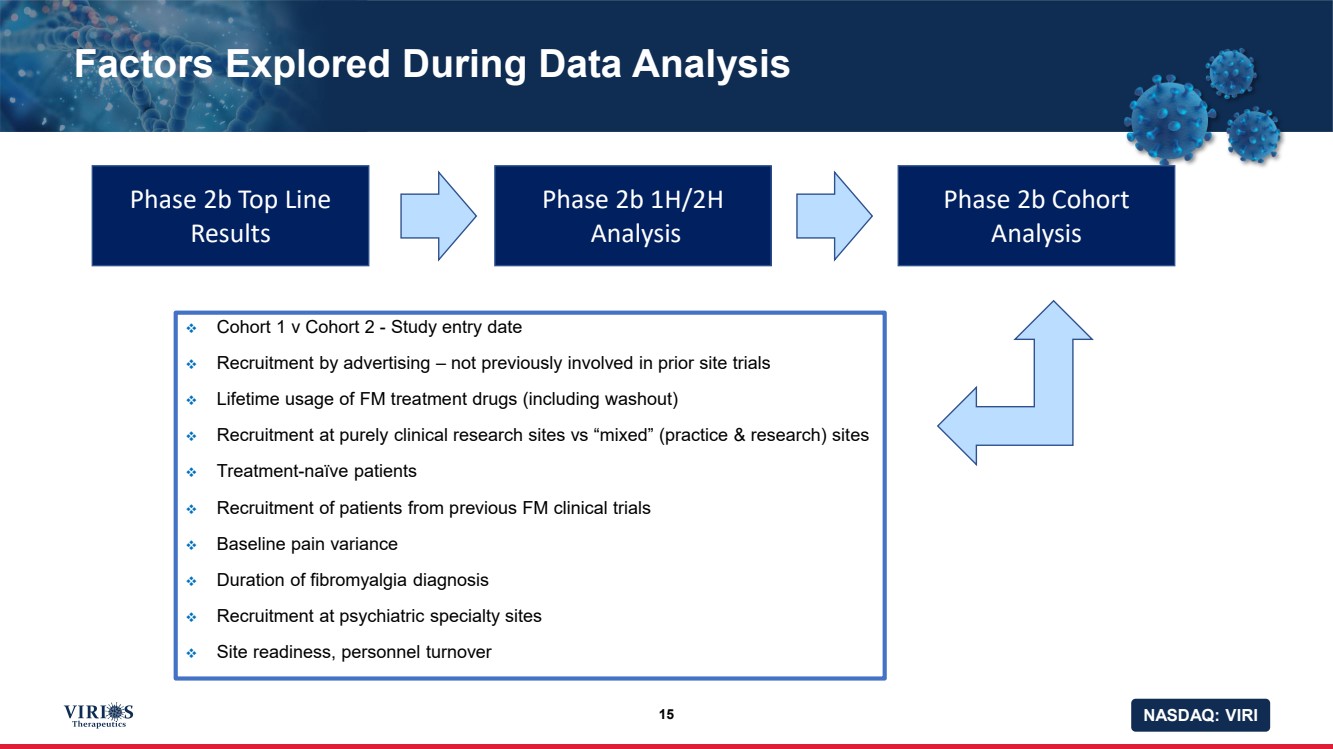

| NASDAQ: VIRI Factors Explored During Data Analysis 15 ❖ Cohort 1 v Cohort 2 - Study entry date ❖ Recruitment by advertising – not previously involved in prior site trials ❖ Lifetime usage of FM treatment drugs (including washout) ❖ Recruitment at purely clinical research sites vs “mixed” (practice & research) sites ❖ Treatment - naïve patients ❖ Recruitment of patients from previous FM clinical trials ❖ Baseline pain variance ❖ Duration of fibromyalgia diagnosis ❖ Recruitment at psychiatric specialty sites ❖ Site readiness, personnel turnover Phase 2b Top Line Results Phase 2b 1H/2H Analysis Phase 2b Cohort Analysis |

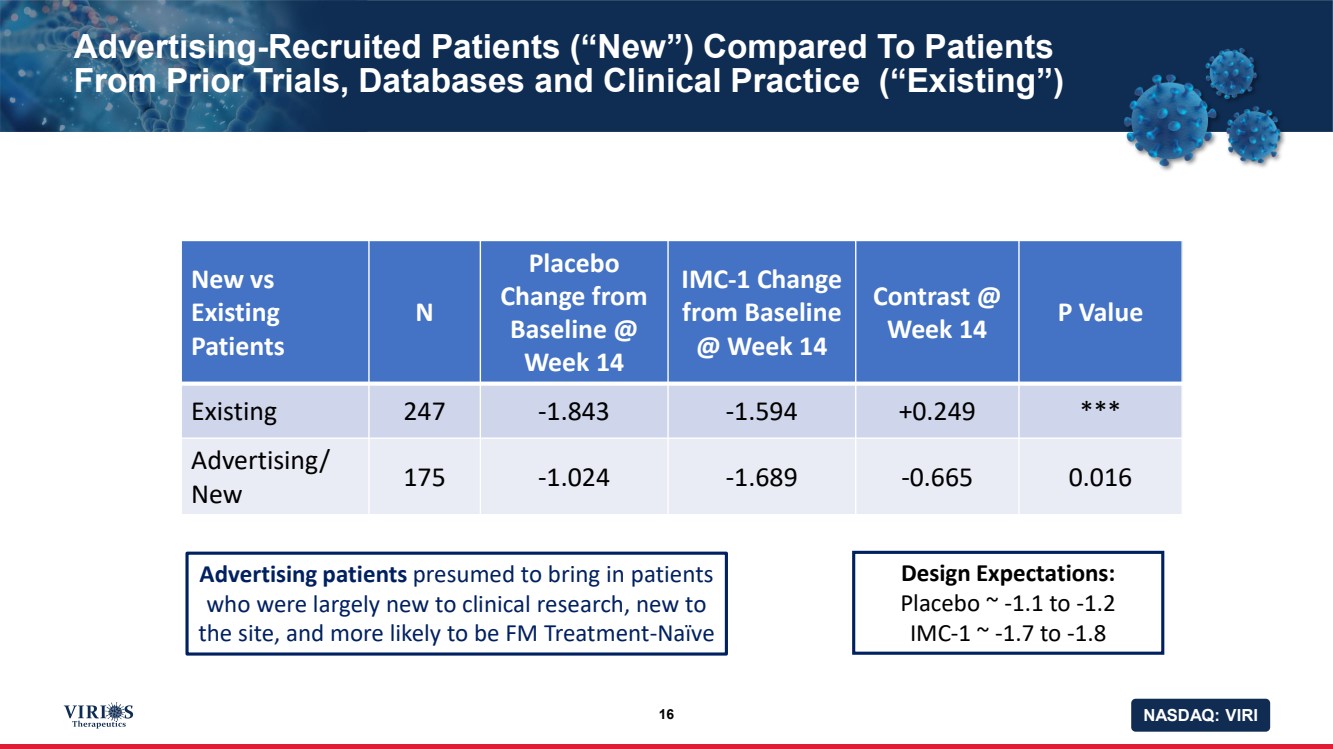

| NASDAQ: VIRI Advertising - Recruited Patients (“New”) Compared To Patients From Prior Trials, Databases and Clinical Practice (“Existing”) 16 New vs Existing Patients N Placebo Change from Baseline @ Week 14 IMC - 1 Change from Baseline @ Week 14 Contrast @ Week 14 P Value Existing 247 - 1.843 - 1.594 +0.249 *** Advertising/ New 175 - 1.024 - 1.689 - 0.665 0.016 Design Expectations: Placebo ~ - 1.1 to - 1.2 IMC - 1 ~ - 1.7 to - 1.8 Advertising patients presumed to bring in patients who were largely new to clinical research, new to the site, and more likely to be FM Treatment - Naïve |

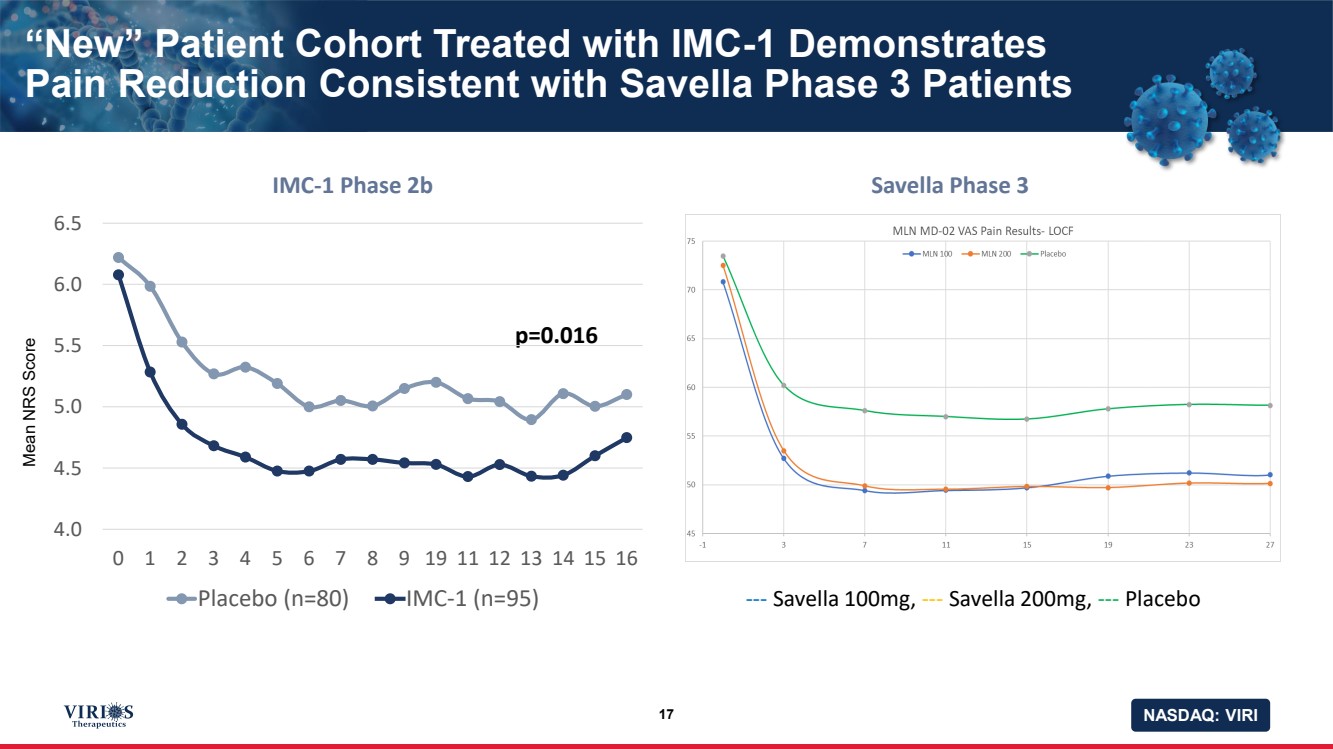

| NASDAQ: VIRI “New” Patient Cohort Treated with IMC - 1 Demonstrates Pain Reduction Consistent with Savella Phase 3 Patients 17 p=0.016 Mean NRS Score Savella Phase 3 4.0 4.5 5.0 5.5 6.0 6.5 0 1 2 3 4 5 6 7 8 9 19 11 12 13 14 15 16 New Patients Placebo (n=80) IMC-1 (n=95) IMC - 1 Phase 2b --- Savella 100mg, --- Savella 200mg, --- Placebo |

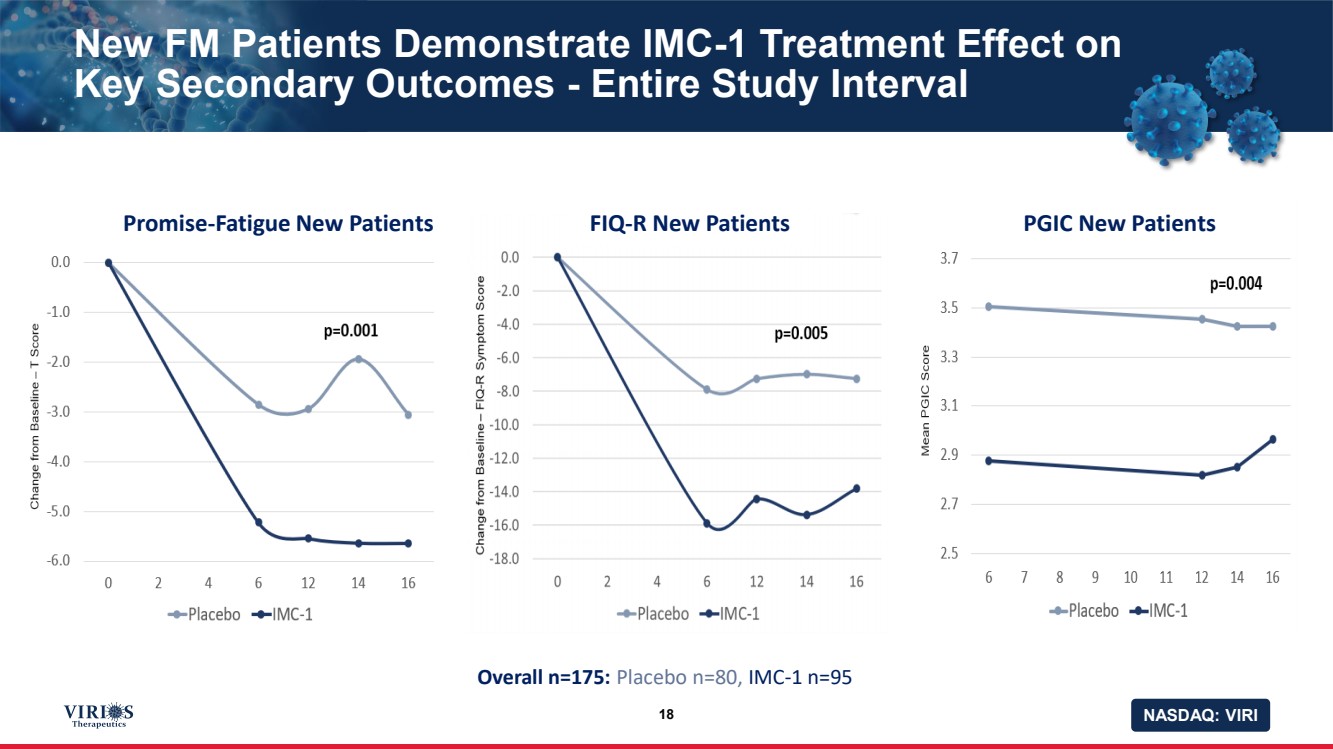

| NASDAQ: VIRI New FM Patients Demonstrate IMC - 1 Treatment Effect on Key Secondary Outcomes - Entire Study Interval 18 Overall n=175: Placebo n=80, IMC - 1 n=95 FIQ - R New Patients PGIC New Patients Promise - Fatigue New Patients |

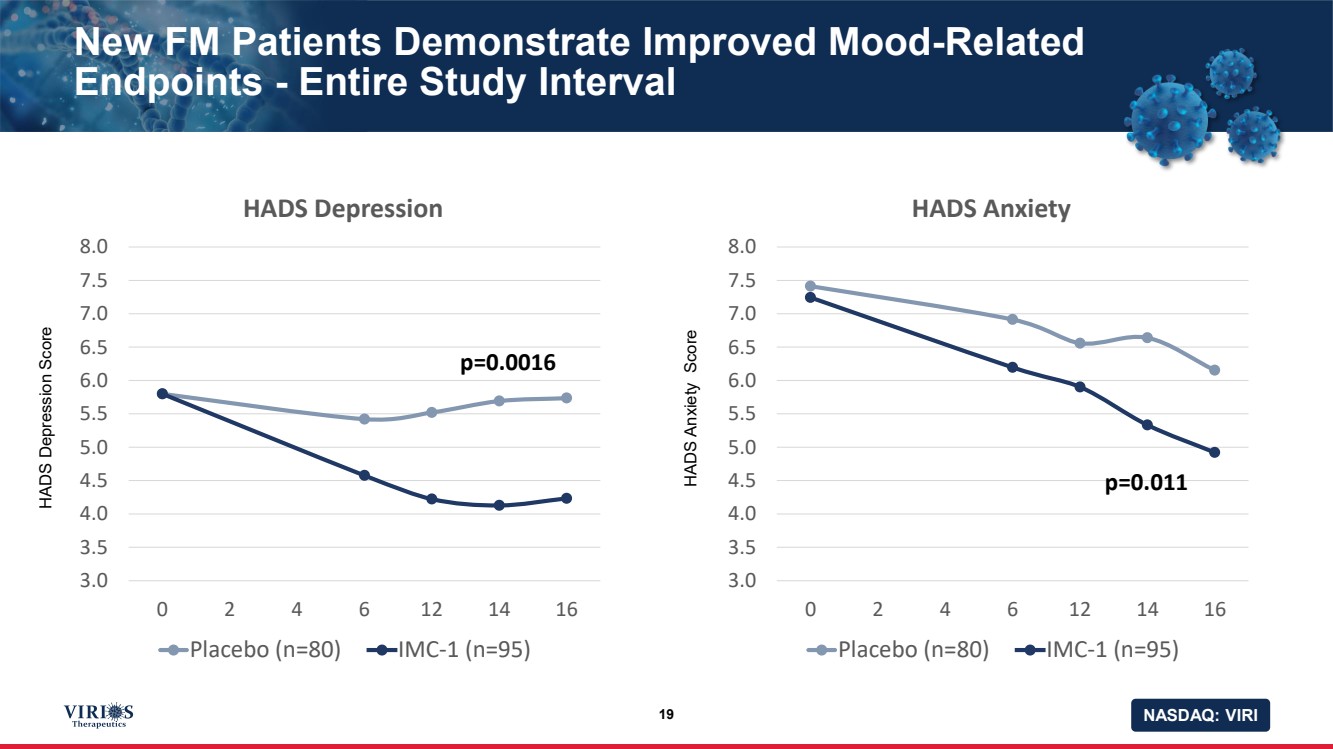

| NASDAQ: VIRI New FM Patients Demonstrate Improved Mood - Related Endpoints - Entire Study Interval 19 HADS Depression Score 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 0 2 4 6 12 14 16 HADS Depression Placebo (n=80) IMC-1 (n=95) p=0.0016 HADS Anxiety Score 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 0 2 4 6 12 14 16 HADS Anxiety Placebo (n=80) IMC-1 (n=95) p=0.011 |

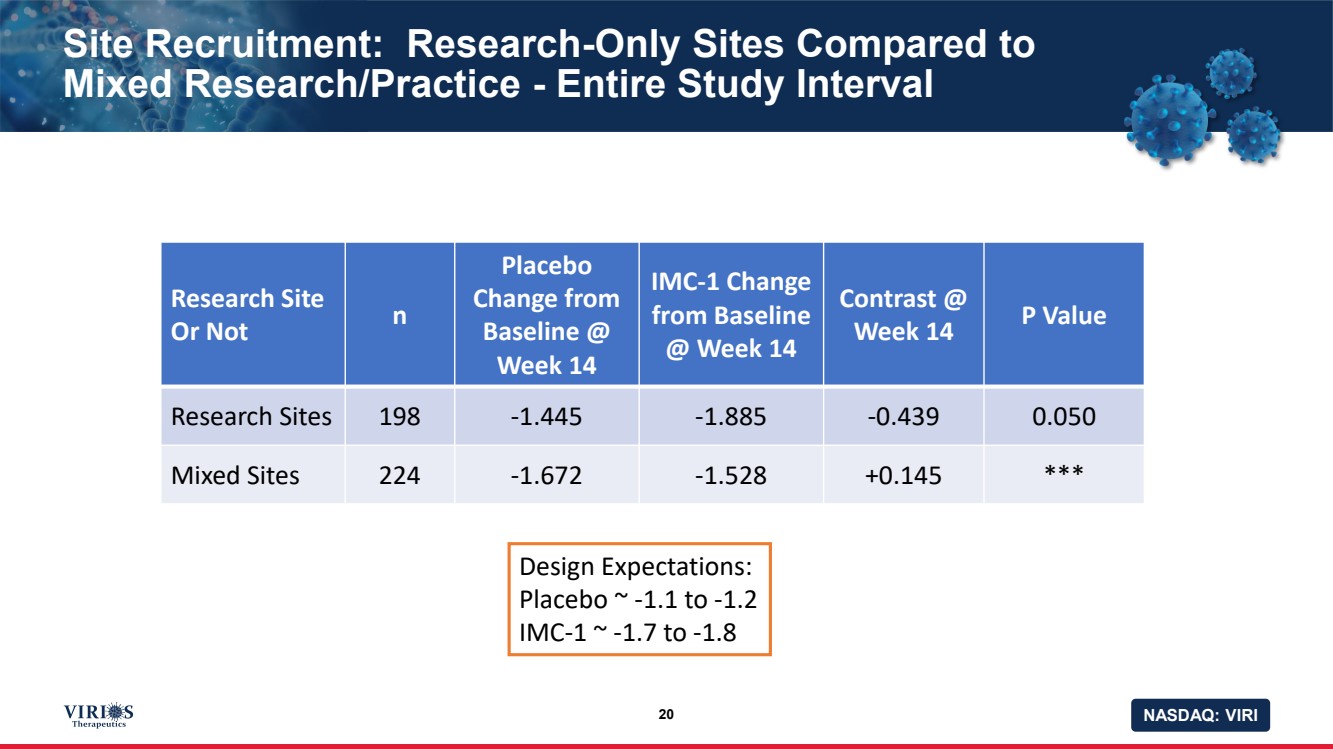

| NASDAQ: VIRI Site Recruitment: Research - Only Sites Compared to Mixed Research/Practice - Entire Study Interval 20 Research Site Or Not n Placebo Change from Baseline @ Week 14 IMC - 1 Change from Baseline @ Week 14 Contrast @ Week 14 P Value Research Sites 198 - 1.445 - 1.885 - 0.439 0.050 Mixed Sites 224 - 1.672 - 1.528 +0.145 *** Design Expectations: Placebo ~ - 1.1 to - 1.2 IMC - 1 ~ - 1.7 to - 1.8 |

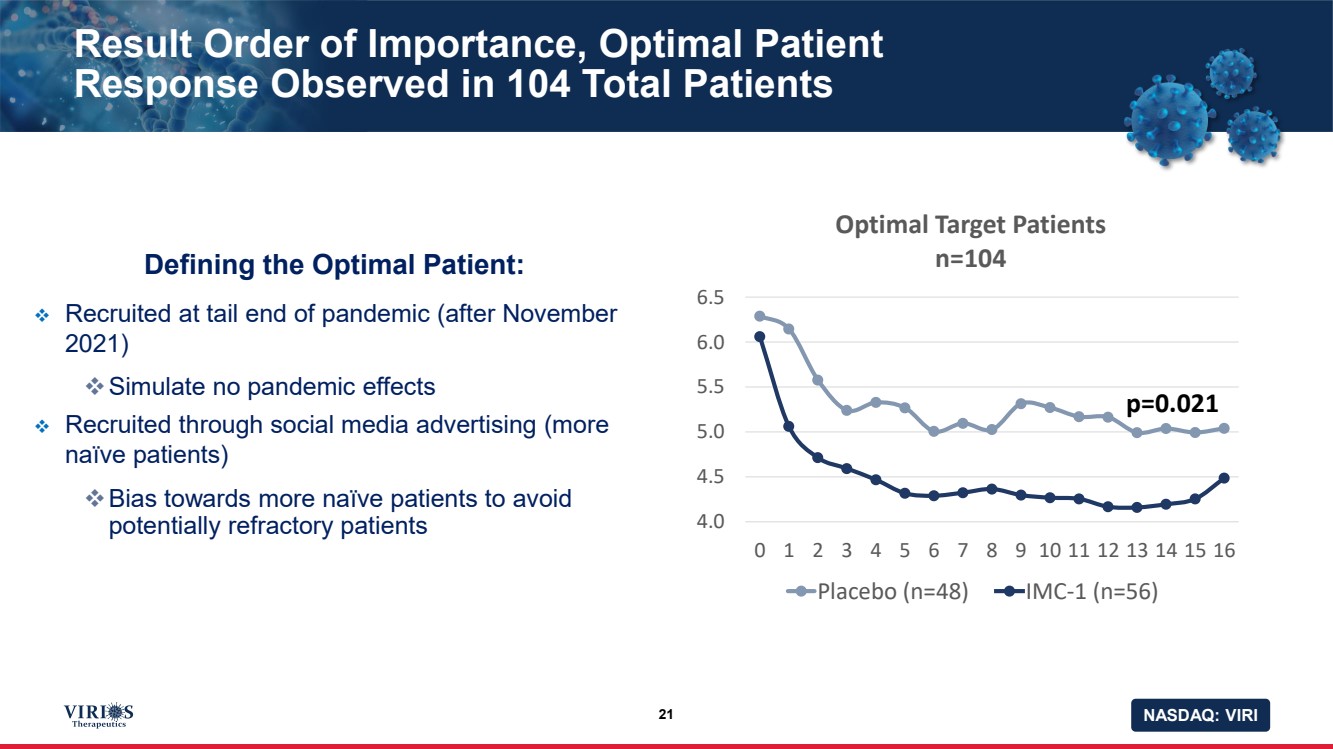

| NASDAQ: VIRI Result Order of Importance, Optimal Patient Response Observed in 104 Total Patients 21 Defining the Optimal Patient: ❖ Recruited at tail end of pandemic (after November 2021) ❖ Simulate no pandemic effects ❖ Recruited through social media advertising (more naïve patients) ❖ Bias towards more naïve patients to avoid potentially refractory patients 4.0 4.5 5.0 5.5 6.0 6.5 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Optimal Target Patients n=104 Placebo (n=48) IMC-1 (n=56) p=0.021 |

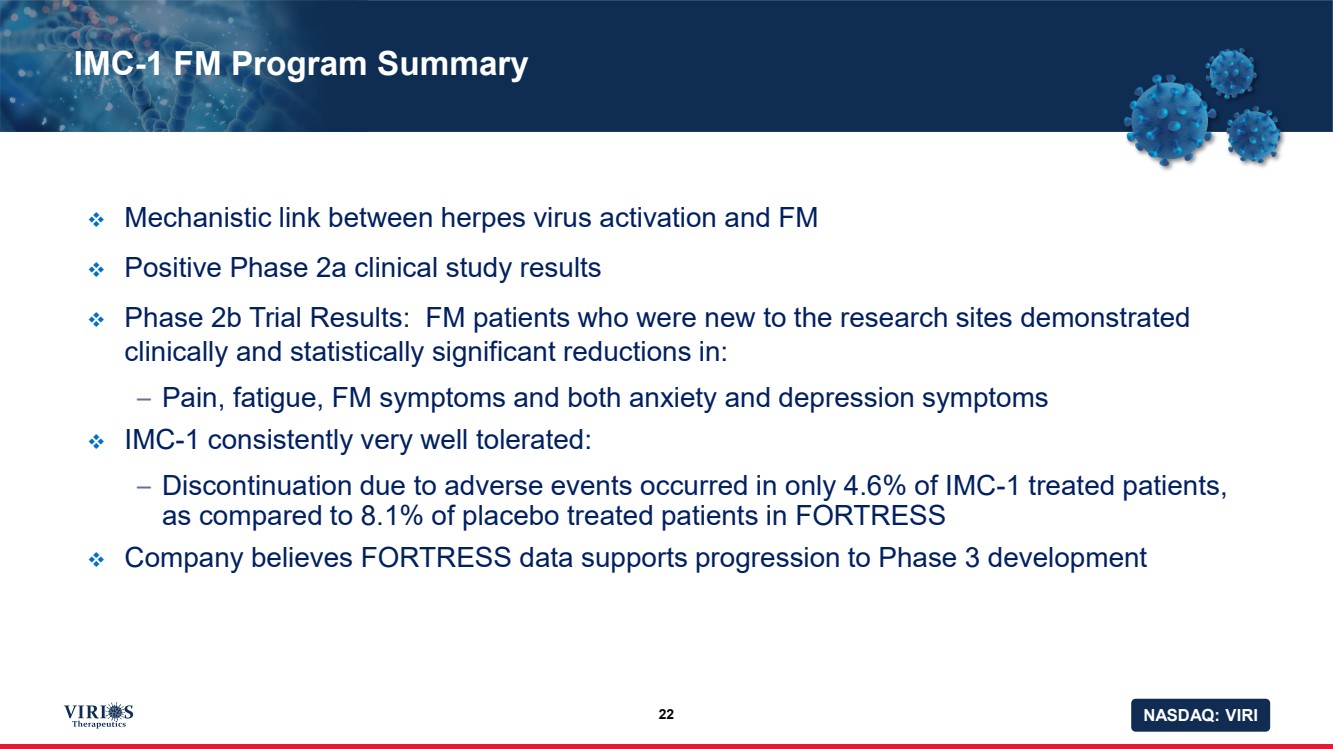

| NASDAQ: VIRI IMC - 1 FM Program Summary 22 ❖ Mechanistic link between herpes virus activation and FM ❖ Positive Phase 2a clinical study results ❖ Phase 2b Trial Results: FM patients who were new to the research sites demonstrated clinically and statistically significant reductions in: – Pain, fatigue, FM symptoms and both anxiety and depression symptoms ❖ IMC - 1 consistently very well tolerated: – Discontinuation due to adverse events occurred in only 4.6% of IMC - 1 treated patients, as compared to 8.1% of placebo treated patients in FORTRESS ❖ Company believes FORTRESS data supports progression to Phase 3 development |

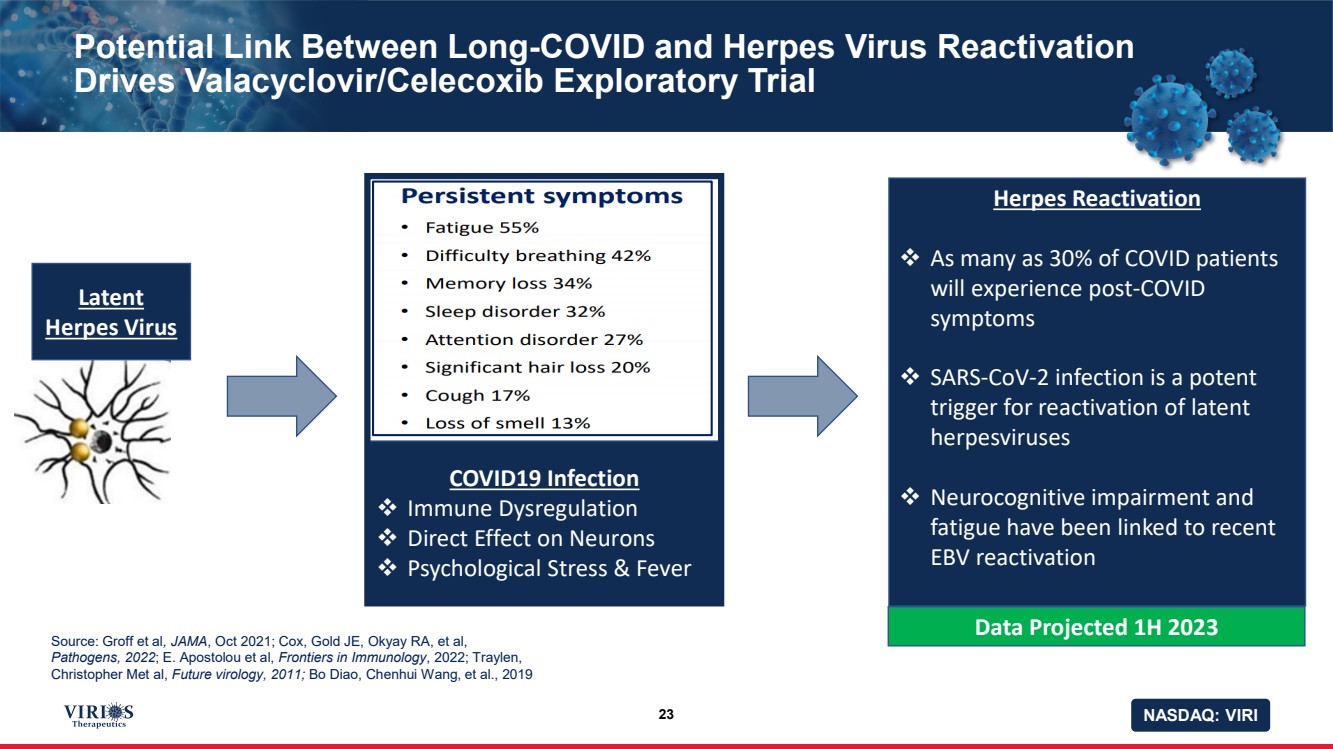

| NASDAQ: VIRI Potential Link Between Long - COVID and Herpes Virus Reactivation Drives Valacyclovir/Celecoxib Exploratory Trial 23 Herpes Reactivation ❖ As many as 30% of COVID patients will experience post - COVID symptoms ❖ SARS - CoV - 2 infection is a potent trigger for reactivation of latent herpesviruses ❖ N eurocognitive impairment and fatigue have been linked to recent EBV reactivation Latent Herpes Virus Data Projected 1H 2023 COVID19 Infection ❖ Immune Dysregulation ❖ Direct Effect on Neurons ❖ Psychological Stress & Fever Source: Groff et al , JAMA , Oct 2021; Cox, Gold JE, Okyay RA, et al, Pathogens, 2022 ; E. Apostolou et al, Frontiers in Immunology , 2022; Traylen, Christopher Met al, Future virology, 2011; Bo Diao , Chenhui Wang, et al., 2019 |

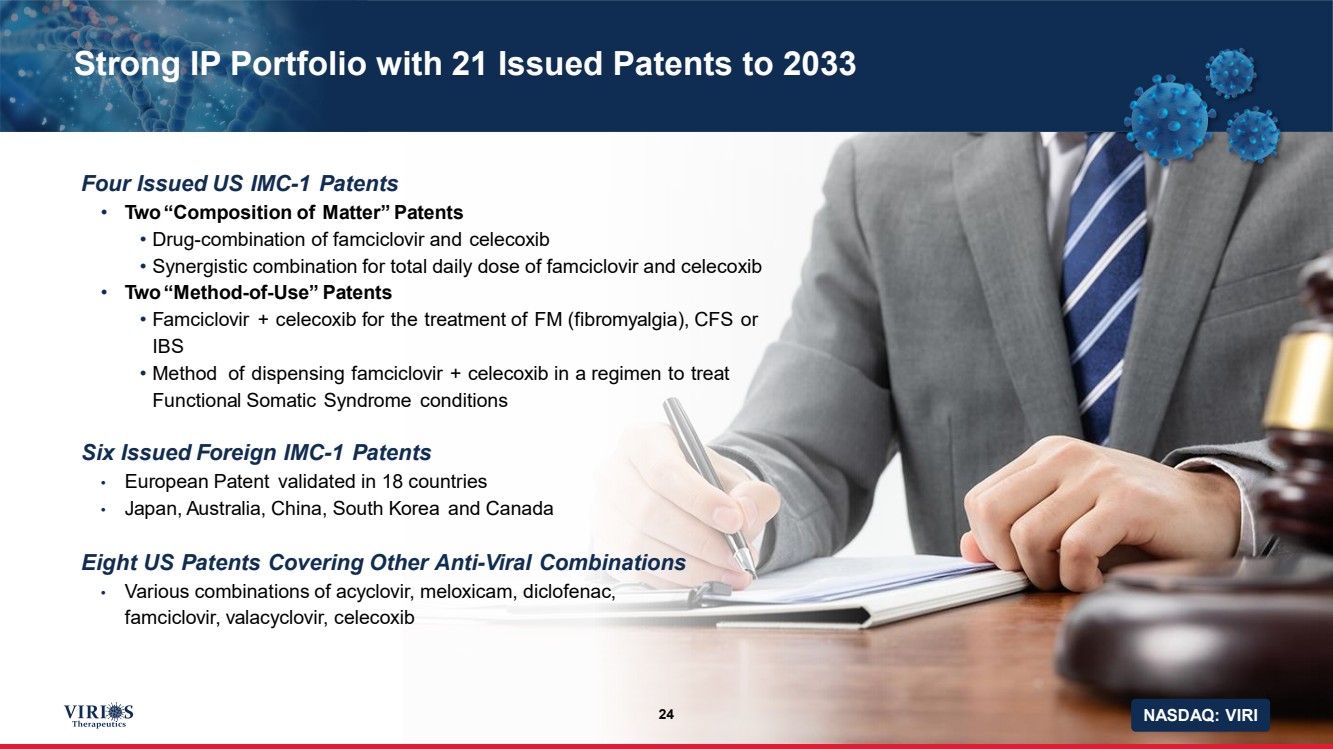

| NASDAQ: VIRI Strong IP Portfolio with 21 Issued Patents to 2033 24 Four Issued US IMC - 1 P atents • Two “Composition of M a tter” P a tents • Drug - combin a tion of famcicl o vir and c e lec o xib • Synergistic combination for total daily dose of famciclovir and celecoxib • Two “Method - of - Use” P a tents • F amcicl o vir + c e lec o xib f or the t r e a tment of FM ( f ib r o m y a lgia), CFS or IBS • Method of dispensing famcicl o vir + c e lec o xib in a r egimen to t r e a t Function a l Som a tic Synd r ome conditions Six Issued F o r eign IMC - 1 P atents • Eu r opean P a tent validated in 18 countries • J a pan, A ust r a lia, China, South K o r ea and Canada Eight US P atents C ov ering Other Anti - V i r al Combinations • Various combinations of ac y cl o vir, m e l o xicam, diclofenac, famcicl o vir, v a lac y cl o vir, c e lec o xib |

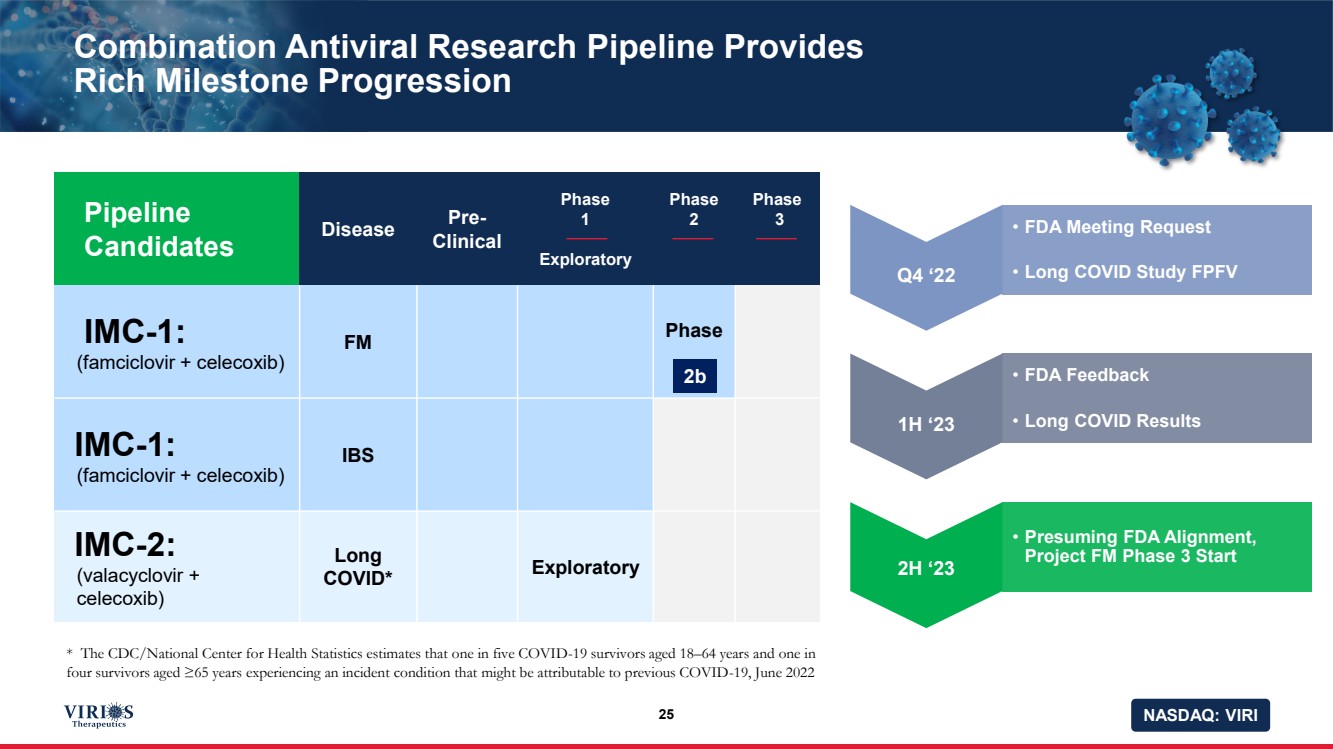

| NASDAQ: VIRI Combination Antiviral Research Pipeline Provides Rich Milestone Progression Pipeline Candidates Disease Pre - Clinical Phase 1 Exploratory Phase 2 Phase 3 IMC - 1: (famciclovir + celecoxib) FM Phase IMC - 1: (famciclovir + celecoxib) IBS IMC - 2: (valacyclovir + celecoxib) Long COVID* Exploratory 25 2b Q4 ‘22 • FDA Meeting Request • Long COVID Study FPFV 1H ‘23 • FDA Feedback • Long COVID Results 2H ‘23 • Presuming FDA Alignment, Project FM Phase 3 Start * The CDC/National Center for Health Statistics estimates that one in five COVID - 19 survivors aged 18 – 64 years and one in four survivors aged ≥65 years experiencing an incident condition that might be attributable to previous COVID - 19, June 2022 |

| NASDAQ: VIRI Virios Therapeutics Summary 26 ❖ First - in - Class Combination Antiviral Development Candidates Target Two Significant Commercial Opportunities: • Fibromyalgia (FM) impacts 2%+ of the population, novelty of approach garners FDA “Fast Track” review designation • Long - Covid sequelae impacts @30% of Covid infected patients, exploratory trial top line data 1H 2023 ❖ Lead Candidate, Oral IMC - 1 (famciclovir + celecoxib) Demonstrated Significant FM Treatment Benefits In Phase 2a Clinical Study: • Reduction in FM related pain, fatigue, anxiety, depression and sleep disruption, tolerability better than placebo ❖ FORTRESS Phase 2b FM Data Demonstrates IMC - 1’s Exceptional Tolerability, Mixed Efficacy Results • New, research naive patients exhibit significant treatment effects • Previously treated patients (e.g. prior research studies, prior treatment) fail to exhibit significant treatment effects • Suggests we may be seeing “refractory” FM patients entering current clinical trials ❖ Will approach FDA to discuss forward development plan: Feedback in 1H 2023 |

| THANK YOU! www.virios.com For Additional Information, Contact: Kirin Smith : ksmith@pcgadvisory.com or ir@virios.com |